Table of Contents

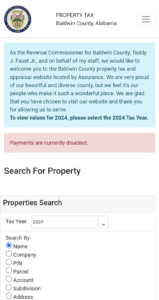

Are you interested in tax lien investing in Baldwin County, Alabama? You’ve come to the right place.

I’ve been there—trying to figure out what these tax lien sales are all about, what the process is like, and more importantly, how to make a profit.

Tax lien sales can be a great investment opportunity, but only if you know how they work.

This guide will walk you through the ins and outs of Baldwin County’s tax lien sale process in a straightforward, no-nonsense way.

Image Credit: https://baldwincountyal.gov/government/revenue-commission/tax-lien-auction

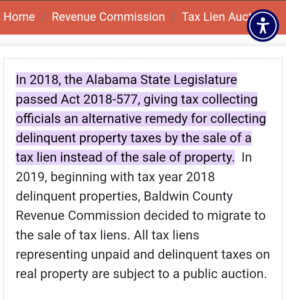

How Baldwin County Collects Property Taxes

Here’s the deal: Baldwin County collects property taxes annually, with taxes becoming delinquent if not paid by December 31.

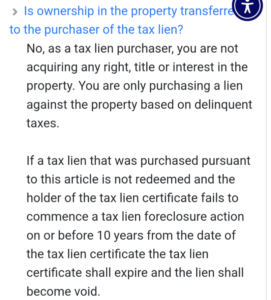

If someone doesn’t pay their property taxes, the county has the right to collect the unpaid amount through a tax lien sale.

Essentially, you’re buying the debt on the property, not the property itself.

If the owner wants their property back, they have to pay you back with interest.

That’s where the potential for profit comes in.

Since 2019, Baldwin County has used tax lien sales instead of selling off properties directly.

This change came after Alabama passed Act 2018-577, giving counties the option to sell tax liens as an alternative way to collect delinquent property taxes.

It’s all about getting those unpaid taxes sorted out, and as an investor, this could be an opportunity for you.

What Happens When Taxes Become Delinquent?

Properties become eligible for the tax lien sale once the owner has failed to pay their taxes by the deadline—December 31.

Baldwin County then prepares the delinquent property list and schedules the tax lien auction.

At this point, the property owner is officially in the “delinquent” category and has to deal with the consequences.

This is where you come in as an investor.

Baldwin County lists all these delinquent properties in a public auction.

The cool part?

You don’t have to physically show up anymore because the auction is held online.

Image Credit: https://baldwincountyal.gov/government/revenue-commission/tax-lien-auction

Baldwin County’s Tax Lien Auction Process

Let’s break down the tax lien auction itself, because this is where the magic (or frustration, depending on how things go) happens.

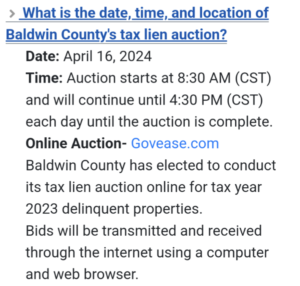

The auction is typically held once a year between March and June.

For 2024, the auction date is set for April 16, starting at 8:30 AM and running until 4:30 PM.

The auction continues each day until all parcels have been offered.

Baldwin County uses an online platform called GovEase, which makes it easier for investors like you to bid from the comfort of your home or office.

Image Credit: https://www.govease.com/

How Bidding Works

In Baldwin County, the tax sale bidding process is pretty straightforward but slightly different from what you might expect.

Instead of bidding more money to win, you’re bidding the lowest interest rate you’re willing to accept on your lien.

The lower the interest rate you bid, the more likely you are to win the lien.

If multiple bidders go as low as 0%, a random number generator will pick the winner.

The maximum interest rate you can bid is 12%.

Pro Tip: You don’t always need to bid super low to win.

Sometimes, going with a reasonable interest rate around 8-10% can still land you a solid lien, especially if others are trying to undercut too much.

What Happens After You Win a Bid?

Congratulations!

You’ve won a tax lien in Baldwin County.

Now what?

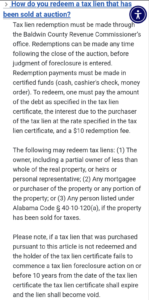

Once you win, you’ll receive a Tax Lien Certificate.

This certificate is your proof that you now hold the lien on the property.

The property owner can redeem (pay off) the lien by paying the amount of delinquent taxes plus the interest rate you bid.

Next Steps:

Keep track of the redemption process.

Baldwin County will notify the property owner that you now hold the lien, and they have a specific redemption period to pay you back (with interest).

If the owner doesn’t redeem the property within the redemption period (typically three years), you can initiate foreclosure and potentially claim the property.

Image Credit: https://leinlord.com/2024-list-of-tax-lien-redemption-periods-by-state

Risks and Rewards of Tax Lien Investing

Tax lien investing can be profitable, but like any investment, it’s not without risks.

Let’s talk about both sides of the coin.

Rewards

- High Returns: In Baldwin County, the maximum tax lien interest rate you can earn is 12%.

That’s way higher than what most banks will give you on any savings account.

- Potential Property Ownership: If the property owner doesn’t redeem the lien, you can foreclose on the property and potentially own it for the cost of the taxes.

Risks

- Redemption: Most owners will redeem the property before their tax lien redemption period ends, which means you get your interest but don’t end up with the property.

- Other Liens and Encumbrances: Buying a tax lien doesn’t wipe out other liens on the property.

If there’s a mortgage or other debts tied to the property, you may have to deal with those before you can claim full ownership.

- Long Wait for Foreclosure: If you’re hoping to acquire the property, keep in mind that the redemption period in Baldwin County is three years.

That’s a long time to wait if you’re banking on foreclosing.

Image Credit: https://baldwincountyal.gov/government/revenue-commission/tax-lien-auction

Registration Process for Baldwin County’s Tax Lien Auction

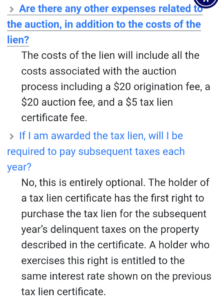

To bid in Baldwin County’s auction, you’ll need to register with GovEase.

Registration typically opens about a month before the auction—in this case, starting March 18, 2024.

Here’s what you’ll need to do:

Create an account on GovEase.

Provide your information, including a W-9 form for tax purposes.

Deposit a 10% refundable bid deposit. This is standard and ensures you’re serious about bidding.

Make sure you familiarize yourself with the GovEase platform before the auction.

They offer training sessions and instructional videos to help you get comfortable with the system.

Pro Tip: Start exploring the auction platform early, and even try placing a pre-bid.

Pre-bidding opens a day before the live auction and can give you a head start on properties you’re interested in.

Image Credit: https://www.govease.com/

What to Know Before the Sale

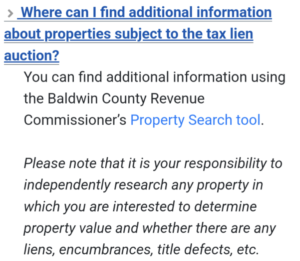

Before jumping into the auction, you need to do your homework.

Not every property listed will be a goldmine.

Some properties may have existing liens, be in poor condition, or just not be worth the investment.

Research, Research, Research:

Use Baldwin County’s Property Search Tool to look up the properties you’re interested in.

Check for any other liens, encumbrances, or legal issues.

Evaluate the property’s location, value, and potential for redemption.

Sometimes properties in desirable areas are more likely to be redeemed (meaning you get interest but no property), while others may be ripe for foreclosure.

Pro Tip: It’s not just about winning a lien—it’s about winning the right lien.

Don’t bid on properties without doing your due diligence.

Image Credit: https://baldwincountyal.gov/government/revenue-commission/tax-lien-auction

What Happens After the Sale?

Once you’ve won a lien, there are a few things to keep in mind:

- Redemption Process: The property owner can redeem the property by paying the back taxes plus the interest rate you bid.

Baldwin County will handle this process and notify you if the owner redeems.

- Foreclosure: If the owner doesn’t redeem the lien within the three-year redemption period, you have the option to foreclose and take ownership of the property.

Keep in mind that foreclosure comes with its own costs and legal processes.

- Ongoing Taxes: As the lienholder, you’re not required to pay future taxes on the property, but you do have the first right to purchase any future liens.

This can be a good strategy if you want to ensure you keep control of the property.

Image Credit: https://baldwincountyal.gov/government/revenue-commission/tax-lien-auction

How to Find the Delinquent Properties List

The Baldwin County Revenue Commissioner’s Office publishes a list of all properties included in the tax lien auction.

This list is usually available by March 31 and includes key information like the owner’s name, the parcel number, and the delinquent taxes owed.

How to Access the List:

Check the Baldwin County Revenue Commissioner’s website or use the GovEase platform to view available properties.

You can also visit the Baldwin County Revenue Commissioner’s office or request the list directly.

Pro Tip: Compare the delinquent property list with online maps and real estate platforms like Zillow to get a sense of the property’s market value before bidding.

Image Credit: https://baldwinproperty.countygovservices.com/Property/Search

Final Thoughts

Tax lien investing in Baldwin County, AL, can be a rewarding experience if you know what you’re doing.

Whether you’re hoping to collect a decent return on interest or aiming to foreclose on a property, understanding the process is key.

Do your research, bid wisely, and always keep the bigger picture in mind.

If you go in with the right expectations and strategy, Baldwin County’s tax lien sale can be a great addition to your investment portfolio.

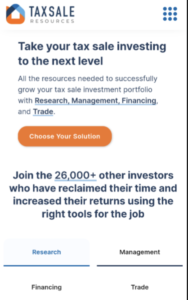

Pro Tip: You can certainly continue to research these tax liens the long way which is 100% free but very tedious and time-consuming, or you can use a high-quality research software such as Tax Sale Resources to get your time back!

Image Credit: Tax Sale Resources Homepage

They Provide:

Access To Upcoming Auctions

Access To Property Reports

Access To Over The Counter List Downloads

Access To Auction Raw List Downloads

And Much More!

Sign Up For A 7-Day Trial Today.

Finally, I believe the best way I’ve found to learn is by doing and “failing forward” as they say.

I bought my 1st investment property in 2020 during the middle of (you know what..cough..cough), and I had no clue what I was doing despite spending months researching how to invest in real estate.

But guess what? I did it.

And learned a ton of valuable lessons along the way!

So,If you’re truly interested in tax lien investing, consider subscribing to my newsletter and following along my journey from landlord to “leinlord” as a new tax lien investor.

As Leinlord grows, my goal is to provide a “behind the scenes” inside look at the tax lien auctions I participate in and thoroughly profile any properties that I win.

You’ll get to ride along with me as I walk through my risk analysis, deal structures, ROI calculations, bidding tactics, and exit strategies all documented for the world to see (even my L’s).

So please show your support and sign up for my newsletter OR if you are a Google Chrome user hit that “follow” button!

(screenshot instructions found on my about page:))

Additionally, if you’re interested in booking a consultation to talk tax lien strategy feel free to schedule a one on one here.

P.S. I am still fairly new to tax lien investing but willing to share what I’ve learned so far, so please keep that in mind before you book!

I’m not an expert… (yet)

Look forward to having you in the Leinlord community!

**Disclaimer

I am not a lawyer, financial advisor, or tax professional. This article is based on my personal research and experience as a tax lien investor. The information provided is for educational purposes only and should not be considered legal, financial, or tax advice. Always consult with qualified professionals before making any investment decisions or taking action related to tax liens. Laws and regulations vary by jurisdiction and can change over time, so verify all information independently. Investing in tax liens carries risks, and past performance does not guarantee future results.

![You are currently viewing Baldwin County, AL Tax Lien Sale Breakdown [A-Z Guide]](https://leinlord.com/wp-content/uploads/2024/09/word-image-1246-1.jpeg)

![Read more about the article How to Buy Land with No Money Down [7 Clever Ways]](https://leinlord.com/wp-content/uploads/2024/03/word-image-868-1-300x300.jpeg)