About Me

Hey all, my name is Kenny and I would like to welcome you to the Leinlord blog.

(yes I know it’s spelled incorrectly www.lienlord.com was taken so here we are..lol)

Anywho, after years of building my real estate portfolio the traditional way (still building btw…), I decided to start exploring the world of tax lien investing. I was intrigued by the prospect of earning “guaranteed” double-digit returns while helping municipalities fund their budgets.

My journey from landlord to “leinlord” as a new tax lien investor is going to be FULL of valuable lessons – some learned the hard way I expect!

As Leinlord grows, my goal is to provide an inside look at the tax lien auctions I participate in and thoroughly profile any properties I win. You’ll ride along as I walk through my risk analysis, bidding tactics, and exit strategies.

Whether I make a profitable flip or get stuck owning the home, I’ll document all outcomes! Also to make things interesting, all net proceeds from this blog will go towards building my tax lien portfolio.

As the blog makes money I will invest those earnings into tax lien opportunities.

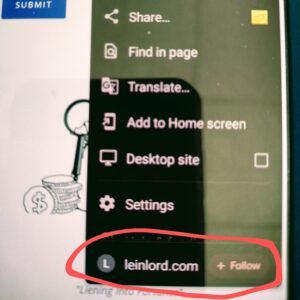

So please show your support and sign up for my newsletter OR if you are a Google Chrome user hit that “follow” button!

(screenshot instructions attached below :))

Now I recognize every tax lien represents a hardship for the original homeowner. Part of ethical investing means respecting the stories behind each property and making reasonable efforts to identify heirs and settle debts before initiating foreclosure.

I want Leinlord to humanize those impacted while still equipping readers with tactics to thrive at tax sale auctions. With many states hosting just one or two large sales annually, precision and preparation are required to stand out from the competition.

Leinlord will chronicle my firsthand efforts researching distressed assets and placing winning bids across multiple jurisdictions.

This site will map out a blueprint, everything from initial property record searches all the way through to acquiring ownership or collecting penalty interest payments.

So whether you’re looking to diversify your investment portfolio outside traditional markets or aspire to scale a larger rental portfolio, tax lien investing can offer that great alternative.

Leinlord welcomes readers just starting out, as well as veteran investors wanting to compare notes. I firmly believe tax lien investing represents a fantastic opportunity that can produce excellent fairly predictable returns very few other asset classes can match.

(not financial advice)

Leinlord pulls back the curtain on the methods, risks, and results from my personal portfolio.

Join me as I explore new auction approaches, and help bring increased transparency into this often misunderstood asset class.

Lets Gooo!!

~Kenny C~

Join the Leinlord Community!

How To Follow Leinlord

Step 1: Click the 3 dots on your (mobile) chrome browser.

Step 2: Scroll down to bottom and hit "follow"