Table of Contents

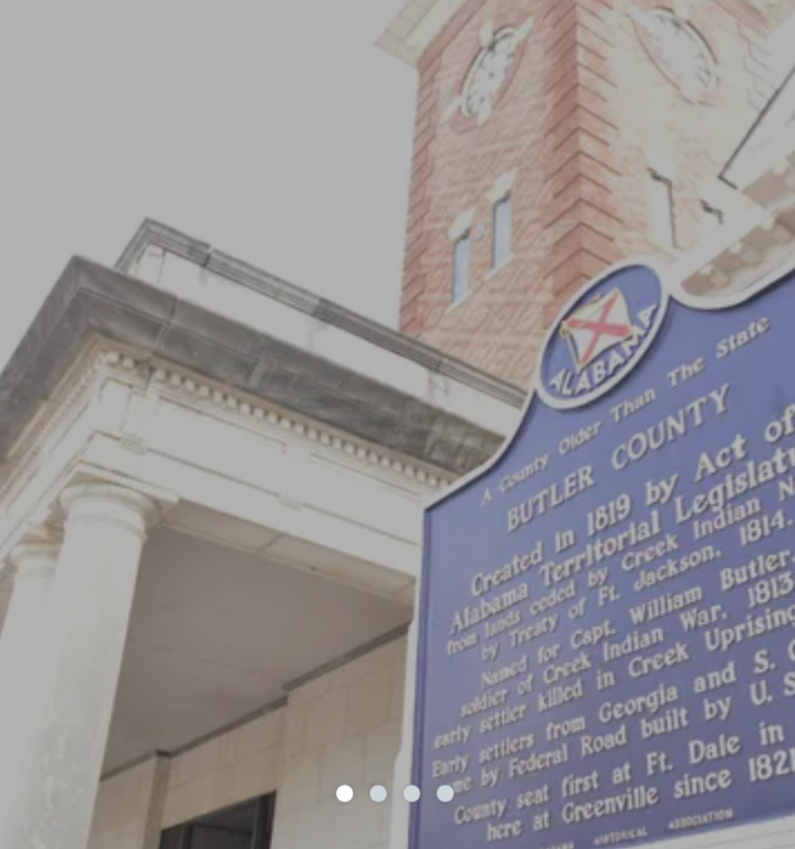

Image Credit: https://www.butlercogov.com/

If you’re looking to invest in tax liens, the Butler County, Alabama tax lien sale could be a great place to start.

With straightforward rules, online auctions, and potential for solid returns, it’s worth understanding how the process works and what you need to know before diving in.

I’ll walk you through the whole process—everything from paying taxes to what happens if the property owner can’t redeem their property.

By the end, you’ll know if this opportunity is right for you and how to get started.

Image Credit: https://www.butlercogov.com/

Understanding Butler County Alabama’s Tax Collection Process

Let’s kick off with a quick overview of how property taxes are collected in Butler County.

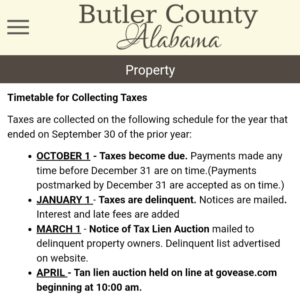

Image Credit: https://butlercountyal.com/#/property

Taxes here are due October 1 each year and can be paid up until December 31 without any penalties.

However, if you miss that December 31 deadline, taxes become delinquent on January 1.

At this point, interest and late fees start stacking up, and you’ll get a friendly reminder from the county telling you it’s time to pay up.

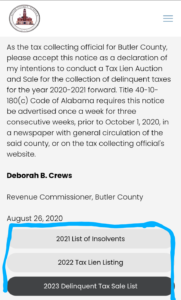

If the taxes are still unpaid come March 1, a notice of tax lien auction is mailed out to the delinquent property owners.

Then the delinquent property list is published on the Butler County website.

Finally, by April 19, the county will hold a tax lien auction to collect those overdue taxes.

Image Credit: https://www.thegreenvillestandard.com/2023/03/29/property-tax-auction-online-april-18/

Who Conducts the Tax Lien Sale and What Happens If You Win?

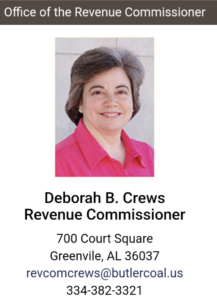

The Butler County Revenue Commissioner is the main person running the show. Deborah B. Crews, to be exact, has the authority to decide how delinquent taxes are collected.

Image Credit: https://butlercountyal.com/taxes#/

And since 2020, the county has chosen to go the tax lien sale route.

So if you’re buying a tax lien in Butler County, it’s all done with her office leading the way.

After winning a bid, you’ll receive a tax lien certificate.

It gives you the right to collect back taxes, interest, and fees. Importantly, this does not make you the owner of the property—yet.

The property owner has three years to redeem the lien by paying off what they owe.

If they don’t, you can begin foreclosure procedures, and potentially take ownership.

Image Credit: https://www.thegreenvillestandard.com/2023/03/29/property-tax-auction-online-april-18/

What Properties Are Sold at the Butler County Tax Lien Sale?

You’ll find all kinds of properties up for auction in Butler County—residential, commercial, vacant lots, you name it.

If the taxes are delinquent, the property might end up on the list.

The list is updated annually and includes a range of property types, so there’s something for every investor’s taste.

One thing to keep in mind is that the property owner can redeem the lien at any time during that three-year period by paying back all the owed taxes, plus interest and fees.

So if you’re eyeing a property because you want to own it outright, remember that redemption is always a possibility.

When and Where the Tax Lien Sale is Held

The Butler County tax lien sale is typically held in April—this year’s sale was on April 19.

These auctions are fully online, and hosted on Govease.com, so you can participate from anywhere.

Registration usually opens up a few weeks before the sale, giving you time to browse the properties and plan your bidding strategy.

It’s worth noting that you can view properties online or visit the courthouse in Greenville if you prefer doing things the old-fashioned way.

The delinquent list is posted right outside the Revenue Commissioner’s door.

(don’t quote me on this)

Image Credit: https://www.govease.com/

How the Butler County, AL Online Tax Lien Auction Works

Butler County tax lien sales are handled entirely online through GovEase.

That’s great news for those who prefer convenience.

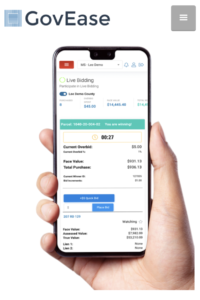

You can bid on properties directly from your phone, tablet, or computer, track your activity on a bidder dashboard, and even enter max bids to make your bidding life easier.

GovEase provides bidder training to help you get comfortable with the platform.

I’d recommend taking advantage of that training, especially if you’re new to online auctions.

It’s not complex, but knowing your way around the system can make the experience much smoother.

Image Credit: https://www.govease.com/

Registration and Bidding Process

To participate in the Butler County auction, you’ll need to register on GovEase.

It’s a simple process—you create an account, add your payment information, and you’re good to go.

You should register as early as possible to allow enough time to familiarize yourself with the platform, review the properties on the list, and plan your bids.

Bidding Tips

The bidding process in Butler County is based on interest rates.

It starts at 12% and goes down. The winning bid is the one willing to accept the lowest interest rate.

For example, if the property owner redeems their property and you’re holding a lien, the interest rate is what they’ll pay you.

So, if you win with a bid of 8%, that’s the interest you’ll receive on top of the tax amount due.

Winning bidders get a tax lien certificate once the sale closes.

This gives you the right to collect the owed taxes and interest or, in cases of non-redemption, potentially foreclose on the property.

Image Credit: https://govease.helpscoutdocs.com/article/136-getting-started-with-govease

Pre-Sale Due Diligence

Before you start bidding, do your homework.

Here’s what to look for:

- Check for Other Liens or Encumbrances: A tax lien sale doesn’t necessarily wipe out other liens. Make sure there aren’t any significant encumbrances on the property.

- Research Property Values: Make sure the property is worth at least what you’re bidding. You don’t want to buy a lien on a worthless piece of land.

- Verify Property Details: Use county records and any available public databases to verify ownership, legal descriptions, and other details.

Actionable Tip: Check Out Govease.com Early

Go to Govease.com before the auction to view all the properties, their tax amounts, and other essential details.

The earlier you start your research, the more informed your bids will be.

Image Credit: https://www.butlercogov.com/revenue-commission

What to Expect Post-Sale

If you win the bid, you’ll receive a tax lien certificate for the amount of taxes due, along with any interest and fees.

Now, you’re in a holding pattern.

The property owner has three years to redeem their property by paying off the taxes, interest, and fees.

If they do, you get paid. If not, you may move forward with foreclosure to claim ownership.

Remember, if the property owner pays their taxes the next year but hasn’t redeemed the lien from the previous year, you can pay the subsequent year’s taxes to keep your lien current.

This is optional but could help you maintain your priority position.

How to Search for Tax Lien Properties in Butler County, AL

To find properties with delinquent taxes in Butler County, start by visiting the county’s official website or GovEase.

Here’s a simple step-by-step:

- Go to Butler County’s Website or GovEase.com

- Look for the Tax Sale Section: This will have the current list of delinquent properties.

- Review the Property Information: Take note of the parcel ID, property description, and amount of taxes owed.

- Make a Shortlist of Potential Properties to target during the auction.

Tip: Use GovEase’s Dashboard for Quick Reference

GovEase offers a dashboard to track properties of interest.

Use this to keep an eye on the properties you’re considering and set up any alerts or notifications if available.

Image Credit: https://butlercountyal.com/taxes.html#/WildfireSearch

Finding the Official Butler County Delinquent Property List

The official list of delinquent properties for Butler County is published both online and in person.

The easiest way to access it is through the county website or GovEase.

You can also visit the Butler County Courthouse, where the list is physically posted outside the Revenue Commissioner’s office.

Remember that properties may be removed from the list if owners pay their delinquent taxes before the sale, so it’s wise to check for updates regularly.

Image Credit: https://www.butlercogov.com/revenue-commission

Key Takeaways and Tips for Investors

To wrap things up, here’s what you need to know to navigate the Butler County tax lien sale successfully:

- Familiarize Yourself Early: Get registered on GovEase, take their training, and review the properties before the auction day.

- Do Your Due Diligence: Research every property thoroughly to know what you’re bidding on and its potential value.

- Understand Redemption Rights: The property owner has three years to redeem the lien. If you’re holding out for a property takeover, be prepared to wait.

- Keep an Eye on Deadlines: Pay attention to key dates—auction day, payment deadlines, and the end of the redemption period.

- Start Small if You’re New: If you’re just getting started, don’t go all-in on your first auction. Buy a few smaller liens to get a feel for the process before making larger investments.

Final Thoughts

Butler County’s tax lien sale can be a lucrative investment opportunity, but like any investment, it comes with its own set of rules and risks.

Do your homework, know what you’re getting into, and have a clear game plan.

With this guide, you should be well on your way to making informed, strategic bids at the next Butler County tax lien auction.

Pro Tip: You can certainly continue to research these tax liens the long way which is 100% free but very tedious and time-consuming, or you can use a high-quality research software such as Tax Sale Resources to get your time back!

Image Credit: Tax Sale Resources Homepage

They Provide:

Access To Upcoming Auctions

Access To Property Reports

Access To Over The Counter List Downloads

Access To Auction Raw List Downloads

And Much More!

Sign Up For A 7-Day Trial Today.

Finally, I believe the best way I’ve found to learn is by doing and “failing forward” as they say.

I bought my 1st investment property in 2020 during the middle of (you know what..cough..cough), and I had no clue what I was doing despite spending months researching how to invest in real estate.

But guess what? I did it.

And learned a ton of valuable lessons along the way!

So,If you’re truly interested in tax lien investing, consider subscribing to my newsletter and following along my journey from landlord to “leinlord” as a new tax lien investor.

As Leinlord grows, my goal is to provide a “behind the scenes” inside look at the tax lien auctions I participate in and thoroughly profile any properties that I win.

You’ll get to ride along with me as I walk through my risk analysis, deal structures, ROI calculations, bidding tactics, and exit strategies all documented for the world to see (even my L’s).

So please show your support and sign up for my newsletter OR if you are a Google Chrome user hit that “follow” button!

(screenshot instructions found on my about page:))

Additionally, if you’re interested in booking a consultation to talk tax lien strategy feel free to schedule a one-on-one here.

P.S. I am still fairly new to tax lien investing but willing to share what I’ve learned so far, so please keep that in mind before you book!

I’m not an expert… (yet)

Look forward to having you in the Leinlord community!

**Disclaimer

I am not a lawyer, financial advisor, or tax professional. This article is based on my personal research and experience as a tax lien investor. The information provided is for educational purposes only and should not be considered legal, financial, or tax advice. Always consult with qualified professionals before making any investment decisions or taking action related to tax liens. Laws and regulations vary by jurisdiction and can change over time, so verify all information independently. Investing in tax liens carries risks, and past performance does not guarantee future results.

![Read more about the article The Calhoun County, AL Tax Lien Sale: [The A-Z Guide]](https://leinlord.com/wp-content/uploads/2024/10/word-image-1342-1-223x300.png)