Table of Contents

Tax lien sales in Autauga County, Alabama, offer great investment potential if you know how to navigate the process.

For investors looking for a solid return, visiting the Autauga County, AL tax lien sale can yield a nice profit.

That said, it’s not a walk in the park. If you’re new to tax lien sales or just curious about how it works in Autauga County, you’re in the right place.

In this article, I’ll break down everything you need to know, from how the tax collection process works to what happens after the sale.

So, let’s dive in.

How the Tax Collection Process Works in Autauga County

In Autauga County, property taxes are due on October 1 each year, and if you miss the deadline, you’ve got until December 31 before things get serious.

After January 1, taxes are officially delinquent, and you’ll be charged 1% interest per month until they’re paid.

What happens next?

The county starts sending out notices, and if you still haven’t paid, they’ll prepare your property for the tax lien sale.

This process gives the county a chance to collect on those unpaid taxes by auctioning off the lien to the highest bidder.

As an investor, this is where your opportunity comes in.

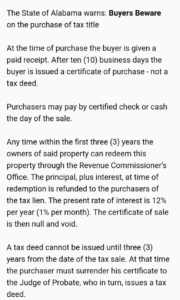

Image Credit: https://autauga.capturecama.com/about

What Qualifies as a Tax Delinquency?

For property to be sold in a tax lien sale, the taxes must be overdue.

Once January 1 hits, you’re looking at a 1% interest charge each month, and the county will add on some extra delinquency charges.

If the taxes aren’t paid, the county will eventually move the property into the tax sale.

For you, the investor, it’s important to know that when you buy a tax lien, you’re paying the amount the property owner owes in taxes plus any penalties and interest.

In return, you’ll be earning 12% interest per year on the lien if the owner redeems the property.

That’s a pretty solid return if you ask me.

Image Credit: https://autauga.capturecama.com/collection

The Tax Foreclosure Process: What You Need to Know

If the property owner doesn’t redeem the property within three years of the sale, you can move toward foreclosure and potentially own the property outright.

The catch?

You can’t foreclose right away.

You’ll have to wait those three years before applying for a tax deed from the Judge of Probate, which officially transfers ownership.

The original owner can still redeem the property by paying you back, but that also includes a 12% interest on top of the taxes you paid, so it’s not a bad deal either way.

Image Credit: https://autauga.capturecama.com/collection

Who Runs the Autauga County, AL Tax Lien Sale?

The Autauga County Revenue Commissioner’s office handles tax lien sales.

These sales usually happen in the commission chambers at the courthouse.

If you’re thinking about participating, you need to appear in person to place your bid. And remember, the lien goes to the highest bidder.

If no one buys it, the lien goes back to the state, but you can still apply to purchase it later through the Alabama Department of Revenue.

Image Credit: https://autauga.capturecama.com/collection

What Types of Properties Are Sold?

Tax lien sales in Autauga County include all kinds of properties.

Whether it’s a vacant lot, a residential property, or commercial real estate, all properties are up for grabs if the taxes aren’t paid.

As an investor, it’s important to research the property before placing a bid.

While you might think a vacant lot could be a quick flip, it’s essential to dig into the details and understand the long-term potential (or problems) with that particular property.

When and Where Does the Tax Lien Sale Happen?

Autauga County’s tax lien sales are typically held in April or May.

Keep an eye on the local newspaper, the Prattville Progress, for the official announcement.

They publish the sale dates about three weeks before the auction. It usually takes place at the Autauga County Courthouse in Prattville.

Pro Tip: Set up a reminder for April and May to check the county’s listings so you can be prepared for the sale.

Image Credit:https://m.facebook.com/AutaugaCountyAL/

How Do the Sales Work?

If you’re attending a tax lien sale in person, get ready for a public outcry auction.

The auction usually starts around 10 a.m., and the property lien goes to the highest bidder.

You’ll need to bring cash or a certified check to pay immediately if you win a lien.

Bidding can be competitive, but remember that your goal is to earn a solid return on the lien, so don’t get caught up in overpaying.

It’s smart to set a limit on how much you’re willing to spend ahead of time.

Image Credit: https://autauga.capturecama.com/collection

The Registration Process

Before you can bid, you’ll need to register with the county.

This typically involves filling out a bidder card and providing a taxpayer identification number.

There’s no fee to register, but some counties may require a deposit based on how much you plan to spend.

It’s always a good idea to confirm the specific registration requirements with the Autauga County Revenue Commissioner’s office before the sale.

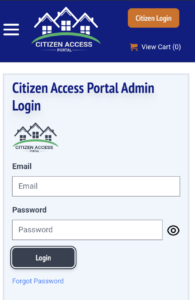

Image Credit: https://autauga.capturecama.com/adminlogin

Bidding: How It Works and What to Expect

Once you’re registered and ready to go, you’ll need to understand how bidding works.

In Autauga County, they use a premium bid method.

This means that you’re bidding on how much you’re willing to pay above the amount of delinquent taxes owed.

Keep in mind, that anything you pay over the base amount is essentially a “premium” and won’t earn interest if the property is redeemed.

What You Should Know Before the Sale

Preparation is key to making smart investments at a tax lien sale.

Before the auction, do your homework on the properties being offered.

Look at the tax delinquency lists available through the county’s Revenue Commissioner’s office.

You can often find these online or request them directly from the office.

Research the properties to see if there are any outstanding issues (like other liens or legal problems).

The more you know, the better your chances of making a profitable investment.

What Happens After the Sale?

If you win a lien, you’ll need to stay on top of the situation.

The property owner has three years to redeem the property.

If they do, you get paid back with interest (12% per year).

If they don’t, you’ll be able to foreclose on the property and potentially take ownership after that three-year redemption period.

But be aware, that foreclosure isn’t automatic—you’ll have to take legal steps to acquire the property, which may require the help of a local attorney.

How to Find Delinquent Properties in Autauga County

The easiest way to find delinquent properties is by visiting the Autauga County Revenue Commissioner’s office or checking their online resources.

The lists are published before the auction, and they’ll include everything you need to know, like the property description, owner details, and how much is owed in taxes.

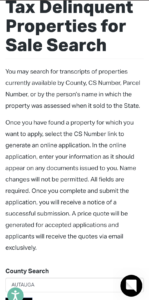

Image Credit: https://www.revenue.alabama.gov/property-tax/delinquent-search/

Final Tips for Autauga County Tax Lien Investors

- Do Your Research: Before bidding, research the property and its condition thoroughly.

- Set a Budget: Don’t get carried away in a bidding war. Set a limit on how much you’re willing to invest, and stick to it.

- Understand the Process: Winning a tax lien doesn’t give you instant property ownership.

Know the redemption period rules, and be prepared to foreclose if necessary.

- Stay Organized: Keep track of your liens, redemption dates, and any legal requirements if you decide to foreclose.

- Reach Out for Help: If you’re unfamiliar with foreclosure or redemption processes, it might be worth consulting a local attorney to help you through it.

Investing in tax liens can be a great way to earn a steady return, but it requires a bit of legwork.

With the right preparation, Autauga County’s tax lien sales offer real profit opportunities.

Just remember to stay focused, do your research, and plan for both the short and long term.

Pro Tip: You can certainly continue to research these tax liens the long way which is 100% free but very tedious and time-consuming, or you can use a high-quality research software such as Tax Sale Resources to get your time back!

Image Credit: Tax Sale Resources Homepage

They Provide:

Access To Upcoming Auctions

Access To Property Reports

Access To Over The Counter List Downloads

Access To Auction Raw List Downloads

And Much More!

Sign Up For A 7-Day Trial Today.

Finally, I believe the best way I’ve found to learn is by doing and “failing forward” as they say.

I bought my 1st investment property in 2020 during the middle of (you know what..cough..cough), and I had no clue what I was doing despite spending months researching how to invest in real estate.

But guess what? I did it.

And learned a ton of valuable lessons along the way!

So, If you’re truly interested in tax lien investing, consider subscribing to my newsletter and following along my journey from landlord to “leinlord” as a new tax lien investor.

As Leinlord grows, my goal is to provide a “behind the scenes” inside look at the tax lien auctions I participate in and thoroughly profile any properties that I win.

You’ll get to ride along with me as I walk through my risk analysis, deal structures, ROI calculations, bidding tactics, and exit strategies all documented for the world to see (even my L’s).

So please show your support and sign up for my newsletter OR if you are a Google Chrome user hit that “follow” button!

(screenshot instructions found on my about page:))

Additionally, if you’re interested in booking a consultation to talk tax lien strategy feel free to schedule a one-on-one here.

P.S. I am still fairly new to tax lien investing but willing to share what I’ve learned so far, so please keep that in mind before you book!

I’m not an expert… (yet)

Look forward to having you in the Leinlord community!

**Disclaimer

I am not a lawyer, financial advisor, or tax professional. This article is based on my personal research and experience as a tax lien investor. The information provided is for educational purposes only and should not be considered legal, financial, or tax advice. Always consult with qualified professionals before making any investment decisions or taking action related to tax liens. Laws and regulations vary by jurisdiction and can change over time, so verify all information independently. Investing in tax liens carries risks, and past performance does not guarantee future results.

![You are currently viewing Navigating The Autauga County, AL Tax Lien Sale: [A-Z Guide]](https://leinlord.com/wp-content/uploads/2024/09/word-image-1220-1.jpeg)

![Read more about the article Baldwin County, AL Tax Lien Sale Breakdown [A-Z Guide]](https://leinlord.com/wp-content/uploads/2024/09/word-image-1246-1-200x300.jpeg)