Table of Contents

About Ted Thomas

Ted Thomas is a former pilot turned Florida-based real estate investing educator, publisher, and author with a specific focus on tax lien certificates and tax deed investing. He’s been in the game for over 30 years, positioning himself as a leading authority in this niche investment strategy.

Through his website, books, and courses, Ted Thomas aims to empower and help everyday individuals navigate the world of tax lien investing. He claims to have helped countless individuals understand the intricacies of this approach and achieve financial success.

Image Credit: https://tedthomas.com/

Ted Thomas’s Background In Real Estate

While details about Ted’s early career path are somewhat limited, he has said in a couple of interviews that he bought thousands of apartment units and small office buildings in California, Arizona, and Nevada in the 1980s. It’s unclear exactly what his specific experience in real estate entails, or if the investment claims he’s made are true but this background likely played a role in shaping his interest in tax lien investing.

The connection between real estate and tax liens is undeniable. Understanding property values, legal procedures, and market trends are all crucial aspects of both domains. It’s reasonable to assume that Ted’s real estate experience equipped him with valuable knowledge that he could then leverage in the world of tax lien investing.

Image Credit: https://tedthomas.com/

Ted Thomas’s Track Record & Expertise With Tax Lien Investing

This is where things get interesting, and also where I want to tread carefully. Ted Thomas positions himself as a highly successful tax lien investor with a proven track record. He claims to have helped thousands of individuals achieve financial freedom through his educational programs and investment strategies.

However, it’s important to approach these claims with a critical eye. Due to the private nature of financial information, verifying the extent of Ted’s success or the specific results achieved by his students is challenging.

Additionally, the world of investment is rife with varying degrees of legitimacy and effectiveness.

What I can tell you is that Ted Thomas has established himself as a prominent figure in the tax lien investing space. He’s built a significant online presence through his website, courses, and social media channels (mainly YouTube).

He actively shares his insights and strategies, attracting a large audience of individuals interested in learning more about this investment approach.

Image Credit: https://youtube.com/@Ted-Thomas

What Is Ted Thomas’s Net Worth?

While the answer to the “ted thomas net worth” question is largely unknown due to privacy laws, etc…

However, we can most certainly “guess” and get a rough estimate of his business’s value based on publicly available information.

So, let’s dive in a bit shall we:

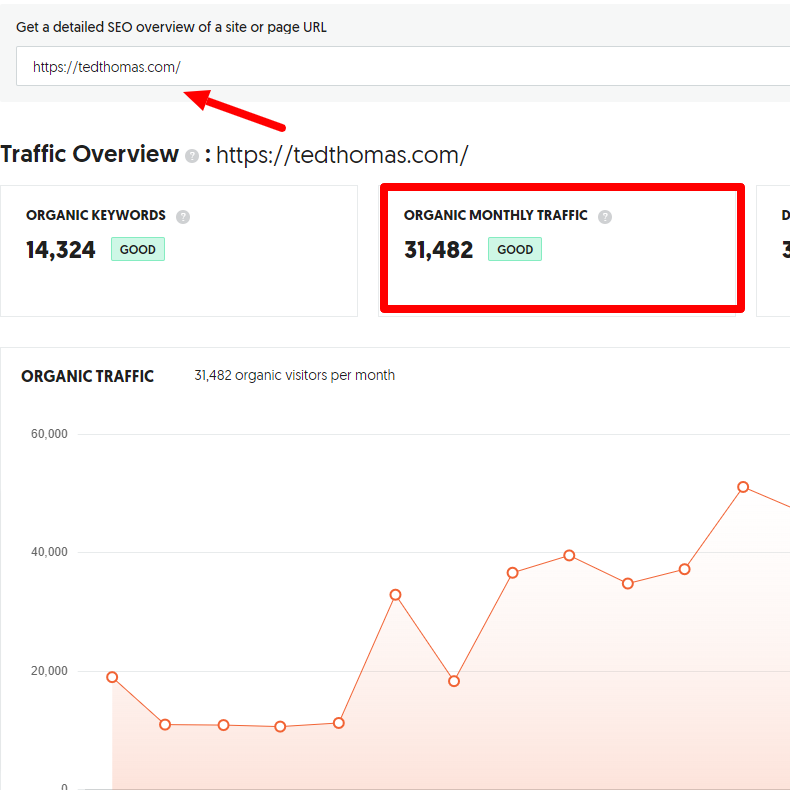

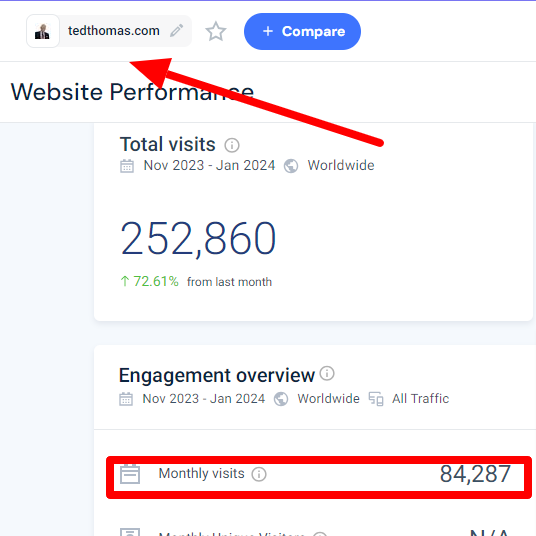

If you take the average monthly visits his website gets:

Ex: 57,885/month (average)

Multiplied By A Conservative 5% Customer Conversion Rate

Ex: 57,885 x 0.05 = 2,894 people buy his stuff each month

Then Multiply His Lowest Priced Product x How Many People Buy Each Month

2,894 x $47 = $136,018

Then Multiply His Estimated Monthly Revenue x 12 To Get His Annual Revenue

$136,018 x 12 = $1,632,216 Gross Revenue

Then Multiply His Annual Gross Revenue x The Average Industry Profit Margin Of An E-Learning Business

$1,632,216 x 0.35 = $571,275.60

Then Multiply Annual Gross Profits x A Conservative 5X Multiplier

$571,275.60 x 5 = $2,856,378

If Ted were to ever sell his business it could potentially command a purchase price of: $2,856,378

So theoretically, “ted thomas’s net worth” is roughly $2.8 Million Dollars.

Of course, this is all speculation and doesn’t include any real estate holdings, stocks, bonds, tax liens, etc.. I haven’t a literal clue what Mr. Ted Thomas is worth but hopefully, this gives a rough estimate of what Uncle Ted is potentially raking in with his education businesses.

Image Credit: https://tedthomas.com/

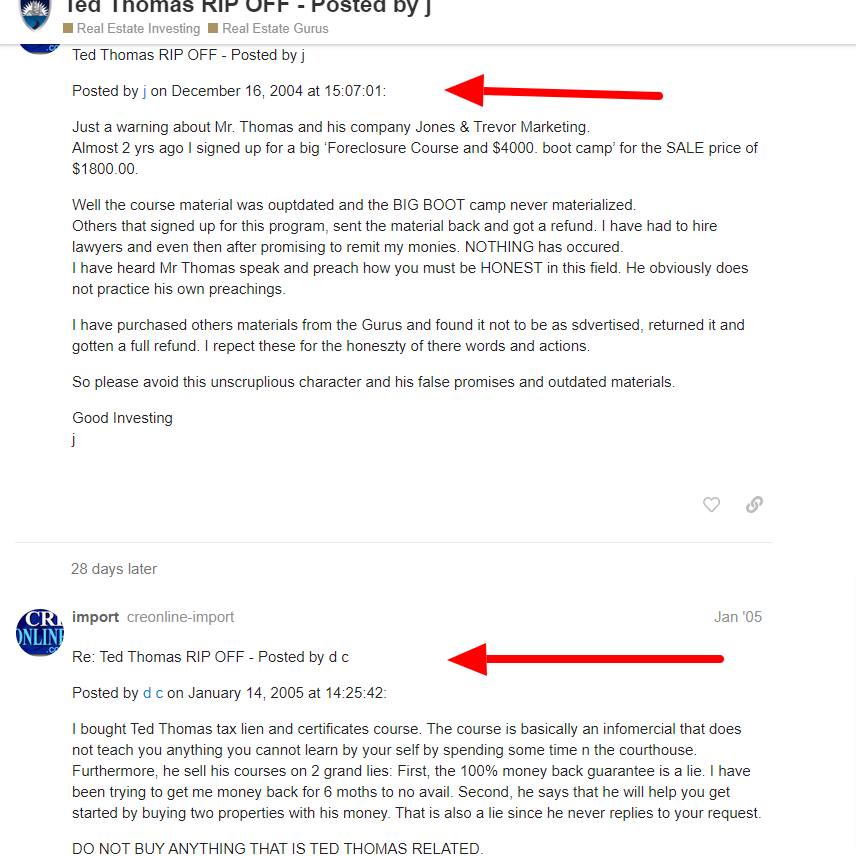

Articles Written About Ted Thomas And His Reputation

Several articles and online reviews discuss Ted Thomas and his approach to tax lien investing. These pieces range from positive endorsements praising his teaching methods and claimed success stories to critical analyses questioning the legitimacy of his claims and the effectiveness of his programs.

It’s crucial to remember that these articles often present individual perspectives and opinions. While some might highlight positive experiences, others might raise concerns or express skepticism. It’s your responsibility to critically evaluate the information presented, considering the source, potential biases, and the overall context.

Here are a couple that I found:

- https://www.propertyleads.com/ted-thomas-course-reviews/

- https://www.biggerpockets.com/forums/70/topics/503969-tax-lien-certificate-training-with-ted-thomas

Archived Ted Thomas Podcast Interviews

Several archived podcast interviews featuring Ted Thomas can be found online. These interviews offer insights into his investment strategies, perspectives on the market, and overall approach to tax lien investing. Listening to these interviews can be a valuable way to gain a deeper understanding of his thought process and communication style.

However, remember that these interviews are promotional platforms to some extent. While they can provide valuable information, it’s important to maintain a critical perspective and consider the potential for biased or self-serving information.

Here are a couple that I found:

- https://www.mixcloud.com/taxlieninvestingpodcasttaxlien/

- https://podcasts.apple.com/us/podcast/065-investing-in-tax-liens-with-ted-thomas/id996717694?i=1000375085286

- https://tedthomas.com/podcast/

- https://www.listennotes.com/podcasts/tax-lien-investing-podcast-tax-liens-ted-VLUewOAaHzc/

- https://flippingjunkie.com/episode-81-tax-liens-investing-in-tax-liens-and-tax-deeds/

- https://www-bestevercre-com.cdn.ampproject.org/v/s/www.bestevercre.com/podcast/jf1198-tax-lien-tax-deed-investing-nationwide-101-with-ted-thomas?amp_gsa=1&_js_v=a9&hs_amp=true&usqp=mq331AQIUAKwASCAAgM%3D#amp_tf=From%20%251%24s&aoh=17088973920364&referrer=https%3A%2F%2Fwww.google.com&share=https%3A%2F%2Fwww.bestevercre.com%2Fpodcast%2Fjf1198-tax-lien-tax-deed-investing-nationwide-101-with-ted-thomas

Are Ted Thomas Books & Ted Thomas Courses Worth The Money?

Ted Thomas offers a range of educational resources, including books and online courses, aimed at teaching individuals the intricacies of tax lien investing. These resources cover various topics, from understanding tax lien certificates to navigating the auction process and acquiring tax deeds.

Image Credit: https://tedthomas.com/

The cost of these resources varies, and promotional offers are frequently available. However, before investing in any program, it’s crucial to carefully evaluate the following factors:

- Curriculum: What specific topics are covered in the course or book? Does it align with your learning goals and investment objectives?

- Credibility: What evidence is provided to support the claims of success or effectiveness? Are there independent verifications of the results achieved?

- Cost-benefit analysis: Weigh the cost of the program against the potential value it offers. Consider alternative learning resources and the potential return on investment.

- Reviews and testimonials: While not definitive indicators of success, reading reviews and testimonials from past students can offer valuable insights into their experiences with the program.

Ultimately, the decision of whether Ted Thomas’s books and courses are worth the money is a personal one. Conduct thorough research, weigh the pros and cons, and ensure the program aligns with your individual needs and financial goals.

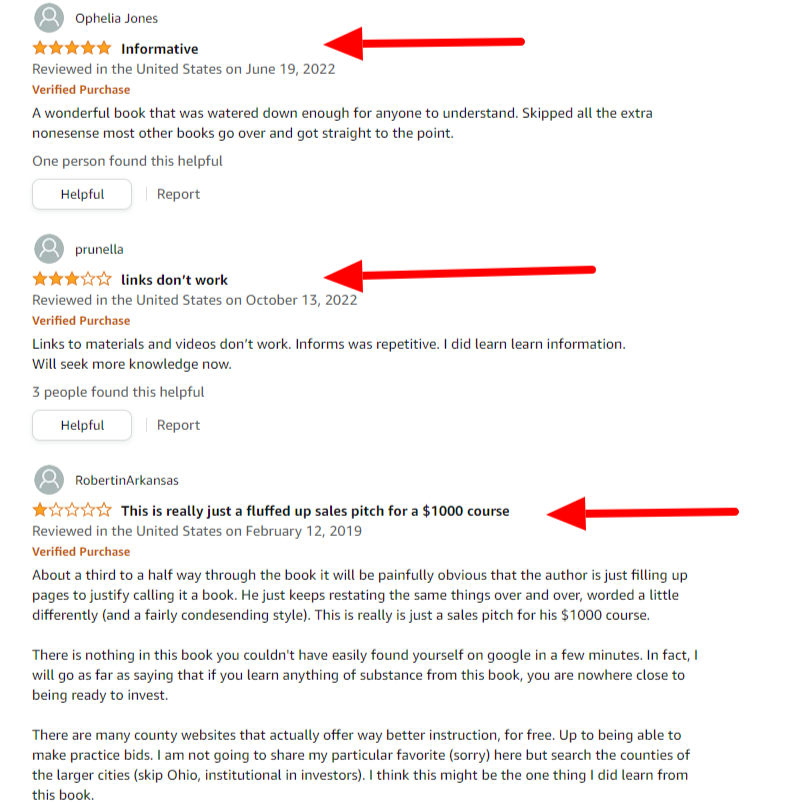

Personally, I haven’t taken any of Ted Thomas’s courses or bought any of his stuff (yet..stay tuned) but here are some quotes I pulled from past students/customers of his:

Ophelia Jones Writes: “A wonderful book that was watered down enough for anyone to understand. Skipped all the extra nonsense most other books go over and got straight to the point.”

Prunella Writes: “Links to materials and videos don’t work. The Information was repetitive. I did learn information. Will seek more knowledge now.”

Reviews & Testimonials From Past Students & Clients Of Ted

Ted Thomas’s website and other online platforms showcase positive reviews and testimonials from past students and clients who credit his programs with helping them achieve success in tax lien investing. These testimonials often express satisfaction with the learning experience, the clarity of the materials, and the positive outcomes achieved.

However, it’s important to remember that testimonials can be subjective and potentially biased. They might not represent the experiences of all participants, and positive outcomes for some individuals don’t guarantee similar results for everyone.

It’s crucial to approach testimonials with a critical eye and consider the following:

- Selection bias: Positive testimonials are often highlighted, while negative experiences might be less visible.

- Individual circumstances: Success stories from others don’t necessarily translate to your own situation. Each investor’s experience is unique and influenced by various factors.

- Focus on the content, not just the claims: Analyze the program’s curriculum, teaching methods, and overall value proposition, rather than solely relying on testimonials.

Again I haven’t taken any of Ted Thomas’s courses or bought any of his stuff (still..stay tuned) but here are some reviews I pulled from past students/customers of his:

My Takeaway (So Far)

Ted Thomas’s journey from real estate to tax lien investing is intriguing, and his experience in both fields undoubtedly shaped his perspective. However, when it comes to his claims of success and expertise, it’s crucial to maintain a healthy dose of skepticism and conduct your own thorough research.

In my opinion, the best way I’ve found to learn is by doing and “failing forward” as they say. I bought my 1st investment property in 2020 during the middle of (you know what..cough..cough), and I had no clue what I was doing despite spending months researching how to invest in real estate.

But guess what?

I did it.

And learned a ton of valuable lessons along the way!

So, If you’re truly interested in tax lien investing, consider subscribing to my newsletter and following along my journey from landlord to “leinlord” as a new tax lien investor.

As Leinlord grows, my goal is to provide a “behind the scenes’ ‘ inside look at the tax lien auctions I participate in and thoroughly profile any properties that I win.

You’ll get to ride along with me as I walk through my risk analysis, deal structures, ROI calculations, bidding tactics, and exit strategies all documented for the world to see (even my L’s).

So please show your support and sign up for my newsletter OR if you are a Google Chrome user hit that “follow” button!

(screenshot instructions found on my about page:))

Additionally, if you’re interested in booking a consultation to talk tax lien strategy feel free to schedule a one-on-one here.

P.S. I am still fairly new to tax lien investing but willing to share what I’ve learned so far, so please keep that in mind before you book!

I’m not an expert… (yet)

Look forward to having you in the Leinlord community!