Table of Contents

About The National Tax Lien Association (NTLA)

The world of tax lien investing is vast and complex, and as I dig deeper to learn more about the industry, the National Tax Lien Association (NTLA) consistently comes up during my research.

As someone who prioritizes education and professional development, I wanted to gain a deeper understanding of this organization, its purpose, and what it offers to individuals like myself.

This post will talk about the association’s history, it’s mission, and the resources provided by the NTLA.

Image Credit: https://www.ntla.org/

Why Was The National Tax Lien Association Established?

As outlined in their official materials, the NTLA’s mission revolves around promoting professionalism, education, and ethical standards within the tax lien industry.

They strive to achieve this by following a mantra called:

“Establish. Educate. Engage.”

“The mission of the National Tax Lien Association (NTLA)™ is to be the primary organization advancing the legislative, regulatory, business, public relations and educational interests of the tax lien industry in the United States. The association is committed to upholding high standards of ethical conduct and operating in accordance with all applicable federal and state laws and administrative rules.”

Source: NTLA’s Mission Page

This approach aims to elevate the professionalism, knowledge base, and ethical conduct within the tax lien industry.

When Was The National Tax Lien Association Established?

The NTLA was established in 1997, I assume by a group of industry professionals and practitioners.

This longevity signifies its continued relevance and the value it provides to its members, having served the industry for over two decades.

Who Started The National Tax Lien Association?

It doesn’t say explicitly anywhere on the website who founded the NTLA, however from what I can tell Brad Westover appears to be one of the founding members of the NTLA.

He’s been in the tax lien industry for decades and is recognized as an experienced and respected leader within the tax lien industry.

Brad and the board of directors bring a wealth of experience and knowledge to the table, shaping the direction and vision of the NTLA.

Image Credit: https://www.ntla.org/page/Board

How Many Members Does The National Tax Lien Association Have?

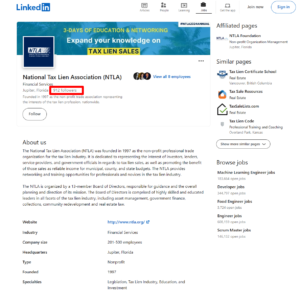

While the exact number of NTLA members is not explicitly stated, we can evaluate the size and composition of the NTLA’s membership based on publicly available information.

So let’s dive in shall we:

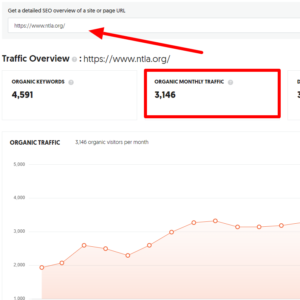

If you take the average monthly visits their website gets:

Ex: 5,746 visitors/month (average)

Monthly Visitors Multiplied By A Conservative 1% Membership Conversion Rate

Ex: 5,746 x 0.01 = 57 people become members each month

Multiply How Many People Become Members Each Month x 12

57 x 12 = 684 New Members Annually (on average)

Multiply How Many People Become Members Annually x Number Of Years in Business

684 x 27 = 18,468 Estimated “Total Members”

So, if NTLA has had new members joining the association at a highly conservative 1% member conversion rate since their founding in 1997, theoretically The National Tax Lien Association has roughly between 900 – 18,000 total members based on this data and their social media following.

Image Credit: https://www.linkedin.com/company/national-tax-lien-association

Of course this is all speculation.. I haven’t a literal clue what The NTLA’s membership numbers are, but hopefully this gives a general idea on what they potentially could be.

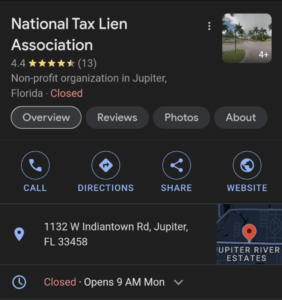

Where Is The National Tax Lien Association Headquartered?

The NTLA is headquartered in Jupiter, Florida. The exact address according to Google Maps is 1132 W Indiantown Rd, Jupiter, FL 33458.

Image Credit: https://tinyurl.com/35b5twth

This strategic location places the association within the heart of a state with a thriving tax lien market, allowing them to stay connected and keep their finger on the pulse in this market.

Image Credit: https://tinyurl.com/35b5twth

What Are The National Tax Lien Association Membership Costs?

Membership in the NTLA starts at $500 annually.

Different membership tiers offer varying benefits and resources, catering to diverse needs within the membership base.

The cost may fluctuate depending on the chosen level of involvement and the specific benefits desired.

I put together a table that lists the NTLA’s annual dues based on your membership type.

(prices subject to change but these are membership costs as of March 2024)

|

Member Type |

Size |

Annual Dues |

|---|---|---|

|

Investor or Servicer | ||

|

$100 Million+ in Size |

$10,000 | |

|

$25 – 99 Million in Size |

$6,000 | |

|

$5 – 24 Million in Size |

$4,000 | |

|

$1 – 5 Million in Size |

$3,000 | |

|

$500K – $1 Million in Size |

$2,000 | |

|

Under $500K in Size |

$500 | |

|

Industry Professionals | ||

|

Attorney/Law Firm |

$2,500 | |

|

Trust Bank |

$2,500 | |

|

Auction Vendor |

$2,500 | |

|

Lien Trading Company |

$2,500 | |

|

Property Title Services |

$2,500 | |

|

Software/Technology Firm |

$2,500 | |

|

Tax Sale Educator |

$2,500 | |

|

Financial Advisor |

$2,500 | |

|

Real Estate Developer |

$2,500 | |

|

Accounting/Consulting Firm |

$2,500 | |

|

Lenders | ||

|

$250 Million+ in Size |

$20,000 | |

|

$150 – $249 Million in Size |

$15,000 | |

|

$75 – $149 Million in Size |

$10,000 | |

|

Under $75 Million in Size |

$5,000 | |

|

Government Officials | ||

|

Tax Collector/County Treasurer |

$150 |

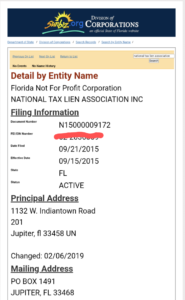

Is The National Tax Lien Association a Legit Association?

Based on my research, the NTLA appears to be a legitimate association.

They maintain a publicly accessible website that outlines their mission, leadership team, and available resources, fostering transparency and accountability.

Additionally, they offer educational programs and promote ethical conduct within the industry, which are hallmarks of legitimate organizations committed to serving their members and the profession they represent.

Also I was able to verify that they are indeed a legitimate association registered in the state of Florida.

Image Source: https://search.sunbiz.org/

(blurred out their EIN for obvious reasons)

Is The National Tax Lien Association a Scam Nonprofit?

The NTLA is registered as a non-profit organization and legitimately recognized as such by the IRS, signifying that their primary focus is not generating profits for their members or any one individual.

Their primary objective, as stated on their website, is actually to serve their members and the tax lien industry, aligning with the core principles of a non-profit organization.

This type of structure ensures that the association’s resources and efforts are directed towards its mission and the benefit of its members rather than individual financial gain.

Here’s their tax exempt status from the IRS

Image Source: https://www.irs.gov/charities-non-profits/search-for-tax-exempt-organizations

About The National Tax Lien Training Programs: What’s Covered

The NTLA offers a diverse range of educational programs, catering to various levels of knowledge and experience within the tax lien investing community.

Image Credit: https://www.ntlauniversity.com/

These programs include:

Webinars: The NTLA frequently hosts webinars covering a wide range of topics related to tax lien investing, from introductory sessions for beginners to advanced discussions on specific strategies and legal considerations.

These webinars offer a convenient and accessible format for learning and staying updated on industry trends.

Conferences: The NTLA organizes annual conferences that bring together industry professionals, investors, and experts for in-depth discussions and networking opportunities.

These conferences often feature keynote speakers, panel discussions, and workshops, providing a valuable platform for knowledge sharing and professional development.

Publications: The NTLA publishes various educational materials, including articles, white papers, and e-books, that delve into diverse aspects of tax lien investing.

These publications offer a valuable resource for members to expand their knowledge base and gain insights from industry experts.

Image Credit: https://www.ntlauniversity.com/

One of the most prominent programs offered by the NTLA is the Certified Tax Lien Professional (CTLP)® designation.

This comprehensive program equips individuals with a thorough understanding of tax lien investing, encompassing topics such as legal frameworks, investment strategies, risk assessment, due diligence procedures, and ethical considerations.

The CTLP® program prepares individuals to navigate the complexities of tax lien investing with confidence and competence.

Image Credit: https://www.ntla.org/page/ctlp

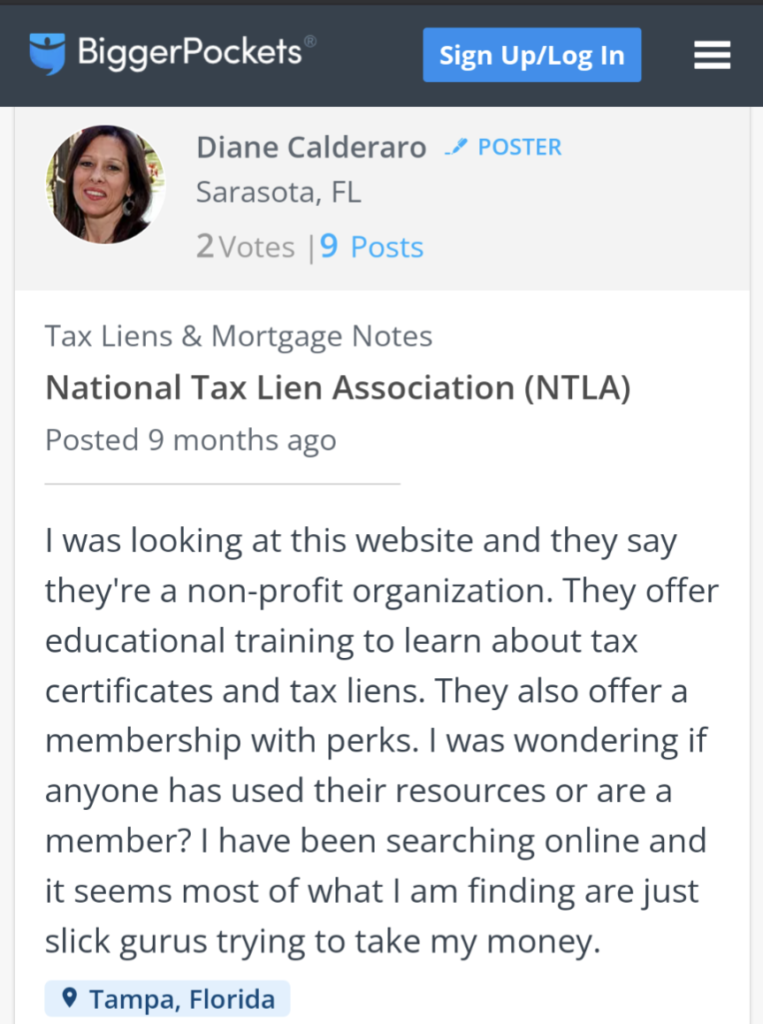

National Tax Lien Training Reviews From Around The Web

Finding unbiased reviews online can be a challenge, and the NTLA is no exception.

However, I did discover some potential students discussing the NTLA’s training options.

Image Credit: https://www.biggerpockets.com/forums/70/topics/1124824-national-tax-lien-association-ntla

Image Credit: https://www.biggerpockets.com/forums/70/topics/1124824-national-tax-lien-association-ntla

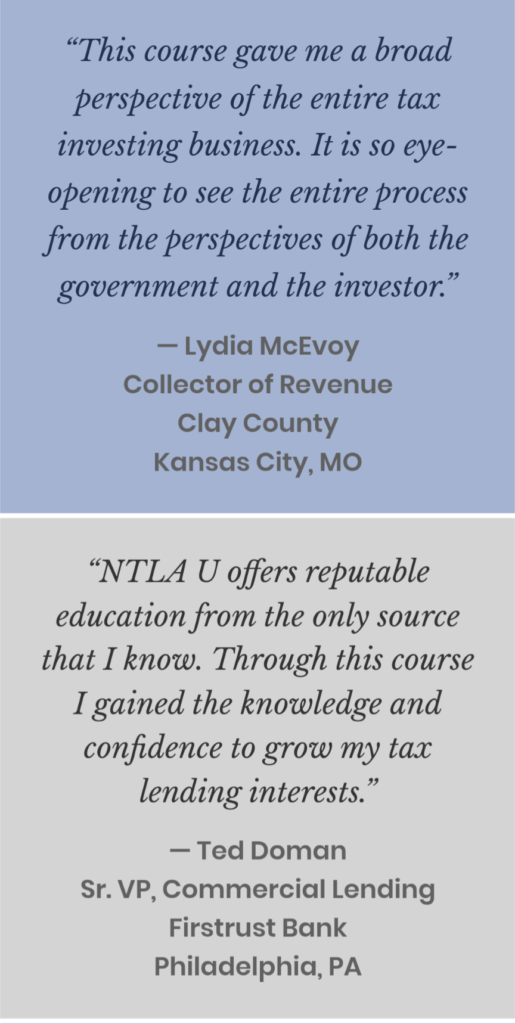

National Tax Lien Association Reviews From Current Members

While I couldn’t directly access reviews from current members, the NTLA training website showcases success stories and quotes from members who have benefited from the association’s resources and support.

Also I managed to find a member testimonial on their member benefits page:

Image Credit: https://www.ntla.org/page/MEMBERBENEFITS

These student testimonials also provide some insight into the member experience.

Image Credit: https://www.ntlauniversity.com/

It’s important to remember that these testimonials are curated by the NTLA, so they might not present a wholly objective perspective.

However, they can still offer valuable insights and perspectives for any individual considering joining the association.

(like myself)

Professional Development Opportunities Offered By The NTLA

The NTLA goes beyond just educational programs and actively fosters professional development opportunities for its members through various initiatives:

Mentorship programs: The NTLA connects experienced members with newer members to provide guidance and support.

This mentorship program allows individuals to learn from seasoned professionals and gain valuable insights from their practical experience.

Networking events: The NTLA organizes regional and national networking events, providing members with a platform to connect with other professionals, share best practices, and build lasting relationships within the industry.

Leadership opportunities: The NTLA offers various leadership opportunities for its members, allowing them to contribute to the association’s growth and development while gaining valuable leadership experience.

These professional development opportunities enable members to enhance their knowledge, skills, and credibility within the tax lien industry, ultimately contributing to their professional growth and success.

Image Credit: https://www.ntlaconference.com/

Networking Opportunities Facilitated By The NTLA

Building strong connections within the tax lien industry is crucial for success, and the NTLA recognizes the importance of facilitating networking opportunities for its members.

They offer a variety of avenues for members to connect and build relationships, including:

Online member directory: The NTLA provides an online member directory that allows members to search for and connect with other professionals based on their location, area of expertise, and other criteria.

Member forums: The NTLA hosts online forums where members can discuss various topics related to tax lien investing, ask questions, and share insights with each other. These forums foster a sense of community and provide valuable peer-to-peer learning opportunities.

Social media groups: The NTLA maintains active social media groups where members can connect, share industry news and updates, and participate in discussions.

These diverse networking opportunities allow members to connect with individuals who share their interests and goals, fostering collaboration, knowledge sharing, and the potential for future partnerships and business ventures.

Image Credit: https://twitter.com/the_NTLA

National Tax Lien Association in The News

The NTLA actively engages in advocacy efforts and has been featured in news articles related to tax lien investing.

This involvement suggests that the association has a voice within the industry and is actively working to:

- Influence policy-making and regulatory frameworks that impact tax lien investing.

- Advocate for the interests of its members and the industry as a whole.

- Educate the public about tax lien investing and its potential benefits and risks.

By actively engaging in these efforts, the NTLA strives to shape the future of the tax lien industry and ensure a fair and ethical environment for all stakeholders.

Here are some links to articles featuring NTLA:

- https://news.wttw.com/2023/02/17/new-legislation-aims-curb-controversial-cook-county-tax-sale

- https://www.investopedia.com/articles/investing/061313/investing-property-tax-liens.asp

- https://www.google.com/amp/s/www.cnbc.com/amp/id/100037758

Image Credit: https://www.google.com/amp/s/www.cnbc.com/amp/id/100037758

My Final Thoughts

As I embark on my journey in tax lien investing, I understand that joining an association like the NTLA is not mandatory for success.

However, it can be a valuable resource for those who are serious about:

- Expanding their knowledge and understanding of the industry.

- Developing their professional skills and expertise.

- Connecting with other professionals and building relationships within the industry.

- Staying informed about industry trends and developments.

In my opinion, the best way I’ve found to learn is by doing and “failing forward” as they say.

I bought my 1st investment property in 2020 during the middle of (you know what..cough..cough), and I had no clue what I was doing despite spending months researching how to invest in real estate.

But guess what? I did it.

And learned a ton of valuable lessons along the way!

So,If you’re truly interested in tax lien investing, consider subscribing to my newsletter and following along my journey from landlord to “leinlord” as a new tax lien investor.

As Leinlord grows, my goal is to provide a “behind the scenes” inside look at the tax lien auctions I participate in and thoroughly profile any properties that I win.

You’ll get to ride along with me as I walk through my risk analysis, deal structures, ROI calculations, bidding tactics, and exit strategies all documented for the world to see (even my L’s).

So please show your support and sign up for my newsletter OR if you are a Google Chrome user hit that “follow” button!

(screenshot instructions found on my about page:))

Additionally, if you’re interested in booking a consultation to talk tax lien strategy feel free to schedule a one-on-one here.

P.S. I am still fairly new to tax lien investing but willing to share what I’ve learned so far, so please keep that in mind before you book!

I’m not an expert… (yet)

Look forward to having you in the Leinlord community!

![Read more about the article The Bibb County, AL Tax Lien Sale Broken Down [A-Z Guide]](https://leinlord.com/wp-content/uploads/2024/09/word-image-1282-1-200x300.jpeg)