Remember, investing in tax deeds is not without its challenges, but for those willing to put in the due diligence, it can be a lucrative addition to your investment portfolio.

As always, seek professional advice and trust your instincts when navigating this complex landscape.

I also am not looking to take advantage of homeowners during tough times, I believe in compassionate, ethical investing always.

With that said let’s dive in..

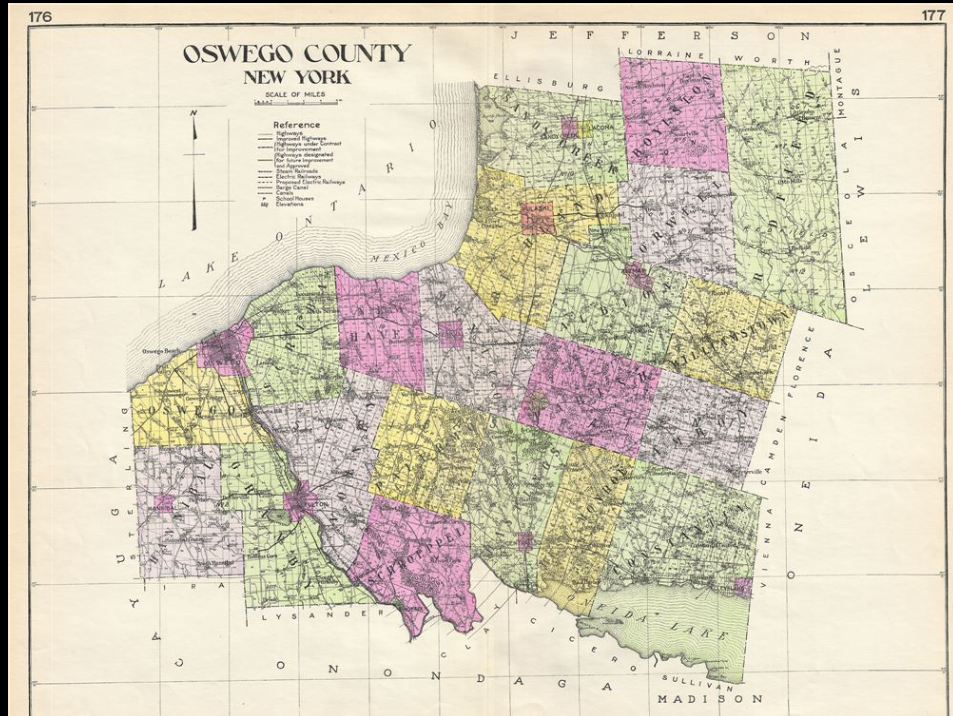

As an ambitious tax deed investor, my ears perked up when I heard about the recent property tax increase in Oswego, New York.

Whenever there’s a significant shift in the tax landscape, it’s crucial for investors like myself to take notice and analyze the potential implications.

Table of Contents

Understanding Oswego’s Property Tax Hike

First, let’s dive into the details of Oswego’s property tax increase. According to recent news reports, many homeowners in the city were shocked to receive letters indicating substantial increases in their home assessments.

Some residents, like Gary Thompson, saw their property values jump by as much as $93,000. Mayor Robert Corradino explained that this is the first full value assessment the city has conducted since 1997, leading to significant adjustments for many properties.

Read Full Story Here: https://www.localsyr.com/news/local-news/oswego-neighbors-frustrated-after-an-increase-in-property-taxes/

Tax Deed Investing 101

For those new to tax deed investing, here’s a quick rundown. When property owners fail to pay their taxes, the local government places a lien on the property.

Investors can then purchase these deeds at auction, essentially paying the delinquent taxes on behalf of the property owner.

In return, investors earn a return on their investment by way of acquiring the property if the owner fails to settle the debt fully.

Oswego, NY Market Analysis for Investors

Now, let’s take a closer look at what this tax increase could mean for the Oswego real estate market.

With higher property taxes, it’s possible that some homeowners may struggle to keep up with payments, potentially leading to an increase in tax delinquencies.

This could create more opportunities for tax deed investors to acquire properties at auction.

However, it’s essential to consider the broader impact on property values and demand.

If the tax hike puts significant financial strain on homeowners, it could lead to a slowdown in the local housing market.

As an investor, it’s crucial to identify specific areas or property types that may still present attractive investment opportunities despite these challenges.

Image Credit: https://www.geographicus.com/P/AntiqueMap/oswegocountyny-centuryatlas-1912

Strategies for Investing in Oswego’s Tax Deeds

If you’re considering investing in Oswego’s tax deeds, there are several key steps to take.

First and foremost, thoroughly research the properties and assess their potential value.

Attend tax deed auctions prepared with a clear bidding strategy and maximum budget in mind.

Once you’ve acquired a deed, be diligent in following local laws and regulations to protect your investment.

Here’s a free tax deed investing checklist you can follow:

1. Research the Oswego Market

- Analyze the current real estate market conditions in Oswego

- Identify areas or property types with the highest potential for investment

- Assess the impact of the recent property tax hike on property values and demand

- Determine the average property owner redemption rates in Oswego, NY if any

2. Understand the Tax Deed Process

- Familiarize yourself with Oswego’s tax deed auction process and timeline

- Review the local laws and regulations governing tax deed investing in Oswego

- Understand the risks and potential returns associated with tax deed investing

- Consult with a legal professional or tax deed investing expert for guidance

3. Evaluate Specific Properties

- Obtain a list of properties with delinquent taxes in Oswego

- Research the assessed value, outstanding taxes, and redemption status of each property

- Conduct a physical inspection of the properties, if possible

- Identify any potential issues or liens that may impact the investment’s profitability

4. Develop a Bidding Strategy

- Determine your investment budget and maximum bid amounts for each property

- Consider the redemption periods associated with each tax deed

- Assess the competition and anticipate other investors’ bidding strategies

- Have a clear exit strategy in place for each property you bid on

5. Attend the Tax Deed Auction

- Register for the auction and obtain any necessary documentation

- Arrive at the auction prepared with your bidding strategy and property research

- Bid strategically on properties that align with your investment goals and criteria

- Keep detailed records of your successful bids and any payments made

6. Monitor and Manage Your Investments

- Regularly check the redemption status of your acquired tax deeds if any

- Follow local laws and procedures for notifying property owners and initiating foreclosure, if necessary

- Consider working with a property management company if you acquire ownership of a property

7. Stay Informed and Adapt

- Monitor any changes in local laws, regulations, or market conditions that may impact your investments

- Stay up-to-date on Oswego’s real estate market and any future tax assessments or hikes

- Continuously evaluate your investment strategy and make adjustments as needed

- Network with other tax deed investors and professionals to share insights and strategies

8. Maintain Ethical and Professional Standards

- Approach investments with empathy and understanding for property owners facing financial difficulties

- Be willing to work with property owners to develop mutually beneficial solutions, when possible

- Adhere to all legal and ethical guidelines in your tax deed investing activities

- Maintain accurate records and reporting for tax purposes

Here is Oswego’s Full Auction Process

Navigating Potential Challenges and Risks

Investing in tax deeds during a time of economic upheaval can come with unique challenges.

It’s crucial to be aware of the reputational risks involved, as some may view investors as profiting from the hardship of others.

If you do acquire a deed on a property with a struggling homeowner, approach the situation with empathy and be open to working out a mutually beneficial solution.

Additionally, stay informed about any changes in local market conditions or government policies that could impact your investments.

Being adaptable and responsive to these shifts can help mitigate potential risks.

Final Thoughts

Oswego’s recent property tax increase presents both opportunities and risks for tax deed investors.

While there may be an uptick in tax delinquencies, it’s essential to carefully evaluate the market and individual properties before diving in.

By conducting thorough research, developing a sound bidding strategy, and staying attuned to local dynamics, investors can potentially capitalize on this unique situation.

BTW….

In my opinion the best way I’ve found to learn is by doing and “failing forward” as they say. I bought my 1st investment property in 2020 during the middle of (you know what..cough..cough), and I had no clue what I was doing despite spending months researching how to invest in real estate.

But guess what? I did it.

And learned a ton of valuable lessons along the way!

So,If you’re truly interested in tax lien or tax deed investing, consider subscribing to my newsletter and following along my journey from landlord to “leinlord” as a new tax deed investor.

As Leinlord grows, my goal is to provide a “behind the scenes’ ‘ inside look at the tax lien auctions I participate in and thoroughly profile any properties that I win.

You’ll get to ride along with me as I walk through my risk analysis, deal structures, ROI calculations, bidding tactics, and exit strategies all documented for the world to see (even my L’s).

So please show your support and sign up for my newsletter OR if you are a Google Chrome user hit that “follow” button!

(screenshot instructions found on my about page:))

Additionally, if you’re interested in booking a consultation to talk tax lien strategy feel free to schedule a one-on-one here.

P.S. I am still fairly new to tax lien investing but willing to share what I’ve learned so far, so please keep that in mind before you book!

I’m not an expert… (yet)

Look forward to having you in the Leinlord community!