Table of Contents

About Brian Petersen

So I just recently learned about this real estate coach named Brian Petersen who supposedly helps regular folks profit from tax lien investing.

Image Credit:https://register.taxliencode.com/

Now that sounds awesome in theory. But does his training really work as advertised?

And is Brian Petersen legit or just another one of those shady “guru” types?

Well I decided to dig in and uncover the truth.

He seems to have made quite a name for himself in the tax lien investing space however, I wanted to dig deeper into his background and credentials to see if he is who he says he is and if his training is really worthwhile.

Let’s dig in shall we…

Brian Petersen’s Background In Real Estate

According to this article, Petersen dropped out of college in 2005 to pursue real estate full time.

Over the next three years, he did pretty well wholesaling and flipping single family homes on the west coast.

But when the 2008 housing crisis hit, it knocked him back a bit financially.

Undeterred, Petersen rebuilt his cashflow by acquiring and renting out multifamily properties.

He seemed happy and profitable again, but quickly realized how much he hated dealing with tenants.

So in search of more passive income streams, he pivoted to tax lien investing.

Now Petersen touts tax liens as “one of the most powerful, passive, highest rate of return options in all real estate.”

And he started a coaching business called Tax Lien Code to teach others the secrets of the tax lien trade.

By his own account, Petersen has trained over 40,000 students in various real estate strategies over the past 12+ years.

Image Credit: https://taxliencode.com/

But he believes tax liens are uniquely scalable – potentially allowing someone to build a multi-million dollar portfolio starting with just a few hundred bucks.

Intriguing claims for sure. But are they legit or just hype?

Image Credit: https://youtu.be/MY7asUxUJDU?si=2nRy8hECfIeDq2vz

Let’s analyze his background and credentials a little closer to find out…

Brian Petersen’s Track Record & Expertise With Tax Lien Investing

I did some digging around and documentation about Mr. Petersen seems kinda thin honestly.

I couldn’t validate specifics on past deals or his total portfolio scope with independent proof really.

However, Petersen does appear to be connected with several big investing seminar industry players like Wade Cook and Ted Thomas.

So the “get rich quick guru’s” do seem to embrace him as one of their own.

Additionally, over 38,000 students have enrolled in TaxLienCode training to date (allegedly) apparently investing over $38 million in tax lien certificates (also allegedly).

So he’s clearly sparking investor interest even if end results remain vague.

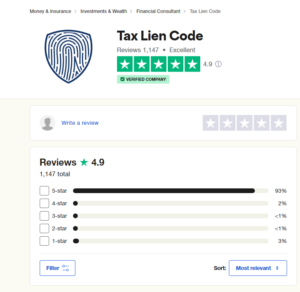

Past tax lien code reviews also show strong support. TaxLienCode currently holds an “Excellent” rating on TrustPilot based on 300+ verified customer reviews.

With clients touting great experiences and solid money made.

Image Credit: https://www.trustpilot.com/review/taxliencode.com

So on the surface, at least it seems Brian Petersen and his team is capable of manifesting some decent tax lien investment outcomes for his “40,000” students.

Though from the limited hard data available, precisely how realistic his income claims are remains fuzzy still.

Either way, Petersen seems to have gotten in the tax lien game just before it started heating up…

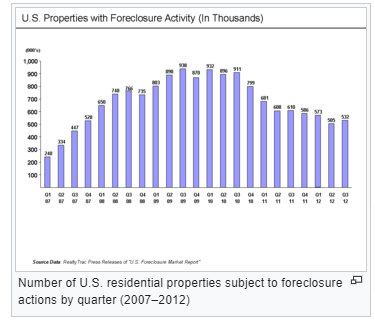

You probably remember that millions lost their homes during the financial crisis. Well as a result, the volume of available tax liens apparently surged nationally between 2007-2010.

Image Credit: https://en.wikipedia.org/wiki/Subprime_mortgage_crisis

Yet because so many traditional real estate investors got battered in the crash, Petersen found way less competition in bidding on tax liens during the turmoil apparently.

So in essence, he stumbled into the perfect tax lien storm where supply was plentiful and demand was anemic, probably allowing him to scoop up tax certificates on the cheap.

And with redemption rates also way down due to the mass foreclosures, Petersen was also likely able to convert a good chunk of those liens into property ownership.

Potentially allowing him to build a lucrative real estate portfolio in the aftermath of the 2008 downturn.

Of course, I can’t validate all the details there. But the timeline does seem to line up reasonably well with both the residential crash and likely subsequent tax lien boom.

So theoretically at least, Petersen’s account of rebuilding through tax liens appears plausible.

As do the claims of experience and expertise he touts today.

(so we think …🤔)

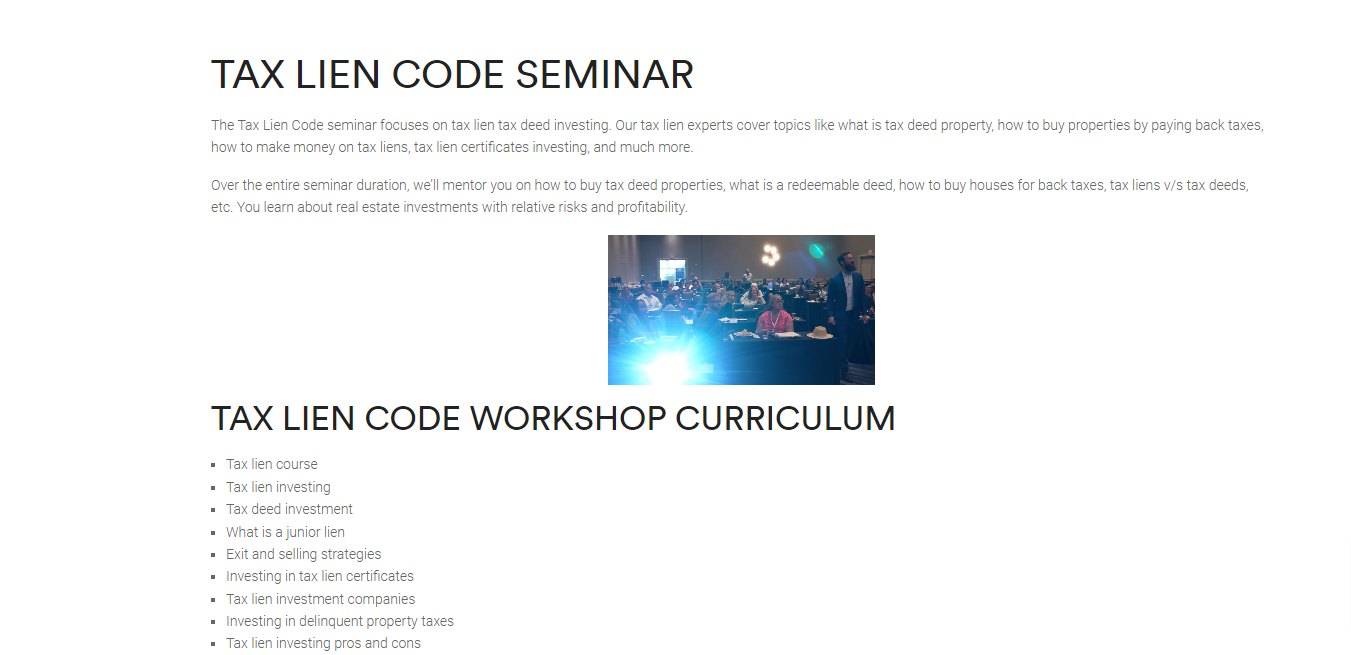

Actual Civil Suit Pertaining To Brian Petersen’s Reputation

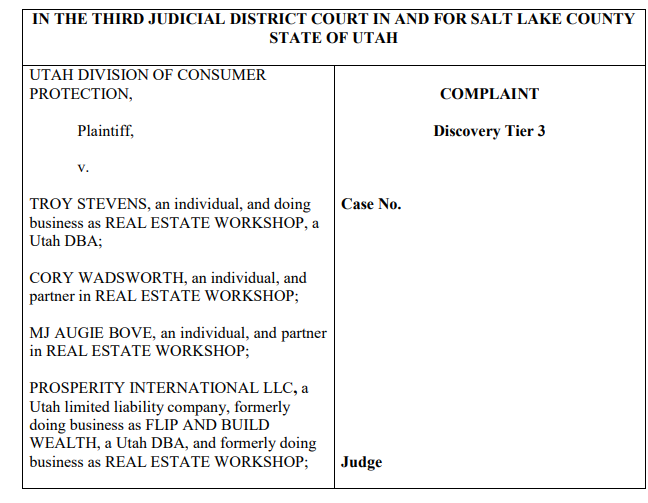

Shockingly, I recently discovered details of an alarming 2019 civil suit brought by the Utah Division of Consumer Protection against “REAL ESTATE WORKSHOP”, a Utah DBA, for which Brian was a salesperson (it appears), as well as several other associated entities and partners.

Image Credit: https://www.courthousenews.com/wp-content/uploads/2019/09/Real-Estate-Scam.pdf

The core allegations centered around deceptive business practices, bait-and-switch style advertising tactics, and encouraging consumers to take on dangerously high levels of debt to purchase questionably overpriced training programs.

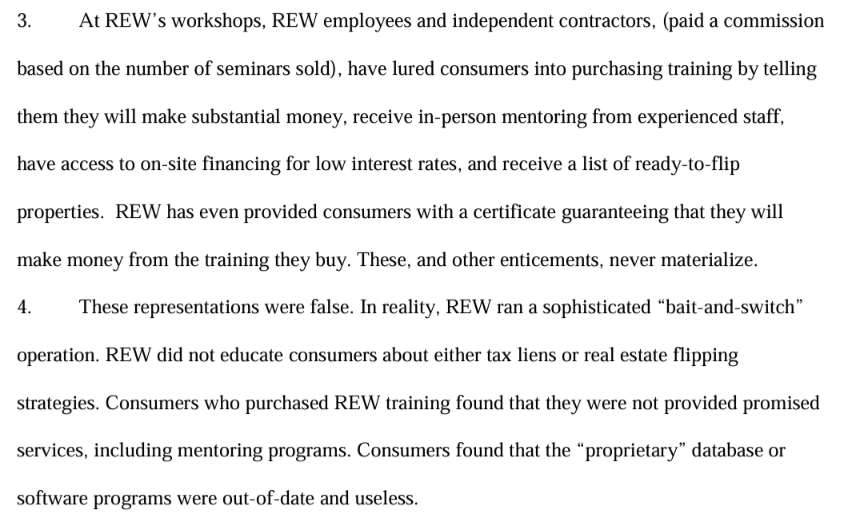

Specifically the suit accused the company “Real Estate Workshop” (REW) of operating a “sophisticated ‘bait-and-switch’ operation” regarding both its tax lien and real estate educational offerings.

It states that REW lured attendees to free local seminars with attractive earnings promises and money-back guarantees.

Then used those events primarily as sales pitch fests pushing $500-$1500 three-day courses.

Image Credit: https://www.courthousenews.com/wp-content/uploads/2019/09/Real-Estate-Scam.pdf

And at those paid follow-on workshops, representatives would again tout sky-high income projections in order to upsell mentoring packages ranging from $25,000 to $50,000.

Image Credit: https://www.courthousenews.com/wp-content/uploads/2019/09/Real-Estate-Scam.pdf

However, according to investigators, REW promised services, software tools, insider secrets and expert support rarely materialized after payment.

Ultimately leaving many customers over-leveraged yet still lacking the resources to actualize the advertised lucrative business opportunities.

Image Credit: https://www.courthousenews.com/wp-content/uploads/2019/09/Real-Estate-Scam.pdf

Now upon initial review the allegations do seem extensively documented and highly troubling if substantiated in court.

In fairness though, Cory Wadsworth and Augie Bove were the main targets of the suit and accused of not only concocting the bait-and-switch model itself but working intimately with sales teams (Brian being one of them “allegedly”) to actively propagate such questionable practices while ignoring obvious legal violations.

Image Credit: https://www.courthousenews.com/wp-content/uploads/2019/09/Real-Estate-Scam.pdf

Equally alarming were claims they provided consumers fraudulent proof-of-funds letters seemingly verifying capital they didn’t actually have.

Along with scripts dishonestly inflating income on credit card applications to spur approvals for buying of additional training products.

Image Credit: https://www.courthousenews.com/wp-content/uploads/2019/09/Real-Estate-Scam.pdf

So in total, the contents of this case shine a really negative light on Brian Petersen’s past coaching integrity and ethical standards in my eyes.

Now I can’t judge ultimate guilt or innocence as the suit looks unresolved at the moment.

However such severe allegations definitely force harder scrutiny regarding transparency, accountability, and strict due diligence moving forward for anyone exploring his premium-priced coaching programs.

From what I can tell either there are extreme lapses in leadership & judgment here or outright illegal activity happening throughout organizations that he’s been involved in.

In any event, I’ll be following along closely to see how these court cases progress.

But in the interim, consider me much more skeptical now having seen these fraud allegations emerge from a consumer protection body such as Utah’s Division of Commerce.

“Curated” Articles Written About Brian Petersen’s Reputation

When researching Petersen’s reputation, one recent Entrepreneur magazine piece stood out offering a seemingly “objective” perspective.

It framed Petersen as leading “The Tax Lien Crusade” – fighting to make this complex investment strategy accessible for everyday investors. (how noble)

Image Credit: https://www.entrepreneur.com/en-in/finance/the-tax-lien-crusade/444143

Apparently, large institutions have capitalized on tax lien investment strategies for years, while lobbying to keep the process opaque and filled with jargon.

This piece presents Petersen as a champion working to demystify tax lien investing for the common man.

Now Entrepreneur itself seems reputable, operating since the 1970’s. And the article took a balanced perspective on both the risks and rewards inherent to lien certificates.

So while not exactly hard-hitting financial journalism, it came across as an even-handed profile that lent credibility to Petersen’s mission.

I found another more critical investigative piece as well from a blogger who questioned why Petersen would teach such an apparently lucrative strategy if it’s so easy and scalable.

And that’s a fair question in my book too. But the article itself speculates quite a bit versus offering hard evidence against Petersen’s actual offerings or business practices.

So for now, credible third-party coverage seems mostly positive, if still fairly limited in depth or scope.

The “too good to be true” angle has been raised, but not yet thoroughly substantiated.

So the jury is still out based on independent reporting alone.

Archived Brian Petersen Podcast Interviews

I dug up a few podcast interviews as well to get insight directly from the horse’s mouth so to speak…

True to form, Petersen paints a rosy picture on the profit potential with tax liens across all his audio appearances. Though specifics do seem to vary some from show to show.

He referenced typical returns between 16-25% on one podcast for instance. Then cited a much wider range up to 45% on another.

But a few key talking points came up repeatedly:

1. Tax liens allow small-scale investing due to low buy-in costs.

2. The government backs both the interest and principal to limit downside risk.

3. Liens legally prioritize investors ahead of even mortgage lenders.

4. If the property owner never pays, the local government eventually hands over deed ownership for huge discounts.

So those foundational mechanisms appeared consistent throughout his interviews.

As did the overarching emphasis on tax liens providing higher, safer returns versus traditional investment vehicles.

However, Brian still focused way more on selling the dream across all his interviews versus managing expectations or addressing pitfalls.

But given the promotional nature of his podcasts, that bias isn’t terribly surprising either.

Is The Brian Petersen Tax Lien Code Course Worth The Money?

Alright, at this point we’ve covered a decent amount into Mr. Petersen’s background, so now let’s examine those flagship training programs and see if the ROI truly justifies Petersen’s premium pricing…

Image Credit: https://taxliencode.com/frequently-asked-questions/

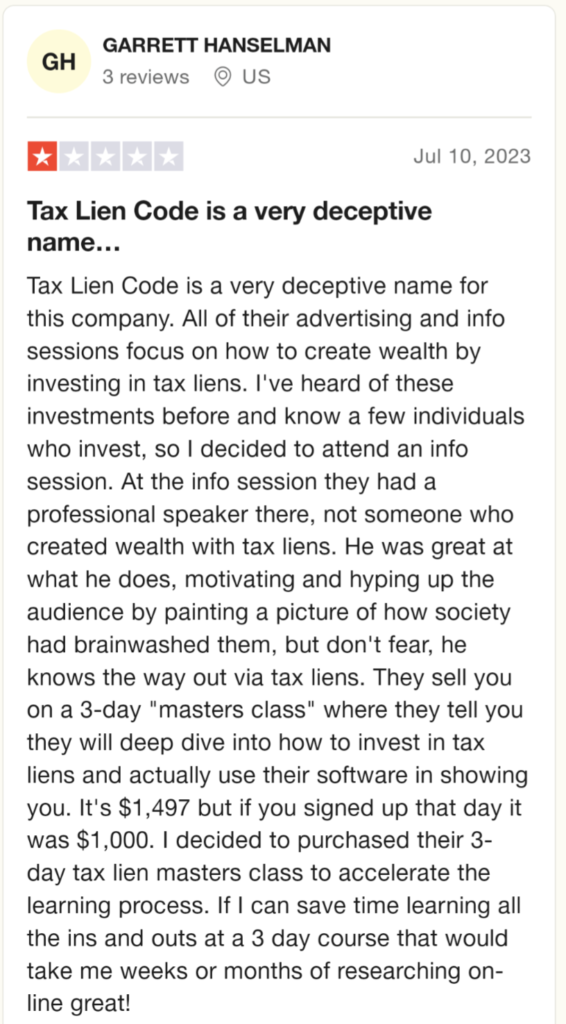

His intro tax lien code course – the Tax Lien Code 3-Day Workshop – costs $1497 (as of March 2024), and is routinely “discounted” to $997 at live events.

Image Credit: https://taxliencode.com/tax-lien-code-seminar/

For that, you get access to 5 online educational modules teaching the fundamentals plus supporting tools like state-specific tax lien lists, county due diligence portals, sample documents, investor forms, and more.

Image Credit: https://taxliencode.com/frequently-asked-questions/

There’s also a full year of email/phone support included, along with lifetime membership in Petersen’s tax lien discussion community providing networking opportunities.

Now for the price, the information provided is probably lighter on actual tax lien mechanics than I’d ideally like to see. The focus feels tilted more towards mindset and motivation versus tangible how-to content.

But customers do give high marks for value overall, with most reporting solid satisfaction even at the higher price point.

Image Credit: https://www.trustpilot.com/review/taxliencode.com?page=28

Where things get truly intense investment-wise however are Petersen’s premium mentorship packages…

Image Credit: https://www.trustpilot.com/review/taxliencode.com?page=28

The entry-level “Platinum” training runs $25,000 with the top-tier “Diamond” version costing upwards of $65,000 in full.

Image Credit: https://www.trustpilot.com/review/taxliencode.com?page=28

And for that sky-high fee, you definitely get an extensive suite of services including:

– Multi-day Tax Lien Investing Summits in Vegas, Dallas & Orlando among other cities.

– In-Field mentoring with Petersen’s network of tax lien coaches

– Ongoing phone & email consulting access

– Enrollment in the Tax Lien Code’s “Exclusive” Mastermind Group

– Lifetime software updates to their PropStream due diligence tool

Plus apparently even assistance forming LLCs for asset protection via their affiliated law firm.

So for what it covers, seemingly even the base $25k level seems at least reasonably well equipped but perhaps still frighteningly expensive to say the least.

The one piece I haven’t quite sussed out yet though is what Petersen’s mentor team qualifications actually entail.

Image Credit: https://taxliencode.com/

Their bios are impressively fluffed up on site. But actual documented investing backgrounds seem oddly absent.

Image Credit: https://taxliencode.com/

And that gives me pause regarding competency holes or conflicts of interest amongst those providing such hands-on tax lien guidance.

After all, their incentives seem aligned more to maximize training profits versus client ROI necessarily.

Image Credit: https://taxliencode.com/

So my lingering questions remain as well as “expert” ambiguity tempers my overall assessment of this program quite a bit.

As does the astronomical price tags here in general, which limit potential ROI.

Still, given the “positive feedback” and seeing firsthand all that’s included, I can “potentially” see Petersen’s premium training justifying the investment IF you fully utilize all the active coaching & support resources provided.

Still not fully convinced at the value being received though… 😕

“Curated” Taxliencode.com Reviews From Past Students

Digging into customer reviews paints a pretty rosy picture overall both on Petersen’s main TaxLienCode site and via third-party rating platforms.

Image Credit: https://taxliencode.com/tax-lien-code-reviews/

On TrustPilot for instance, they hold an “Excellent” 4.9/5 star rating over 1,000+ reviews. And clicking through shows glowing commentary full of success stories and rave reports.

Image Credit: https://www.trustpilot.com/review/taxliencode.com?page=28

Now oddly enough, the handful of negative ratings reference issues like payment processing errors or refund delays.

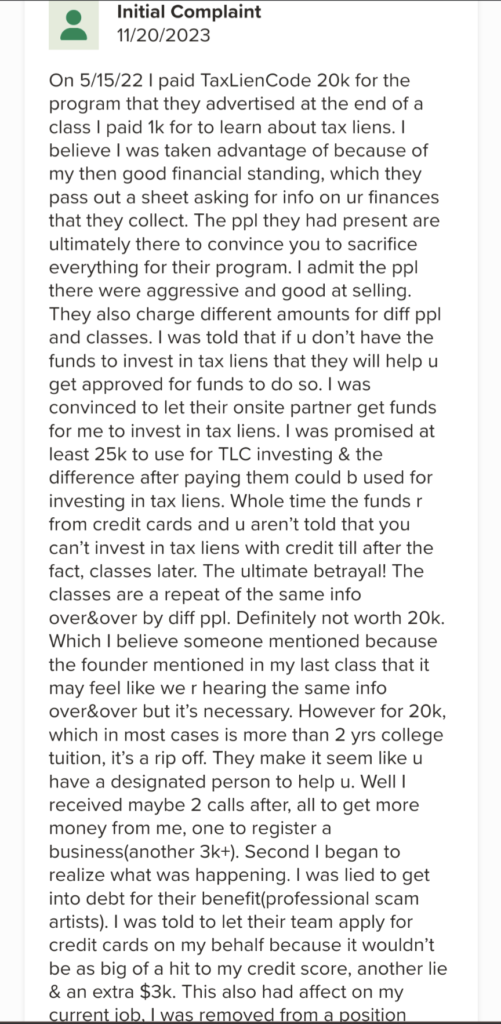

And some BBB complaints taking issue with the actual tax lien curriculum itself.

Image Credit: https://www.bbb.org/us/ks/overland-park/profile/investment-seminars/tax-lien-code-0714-1000053142/complaints#737150212

So in total, rave third-party reviews plus a mix of powerfully persuasive negative customer testimonials help paint a little bit of a clearer picture.

My big lingering question however is whether the team at Tax Lien Code can sustain this forever.

The curated reviews seem to focus heavily on early victories with much less on ongoing profit durability going forward.

Which is concerning….

“Curated” Results From Past Brian Petersen Tax Lien Code Events

While Petersen doesn’t publicly share broader event-level metrics, I did a little more digging into past workshop results.

And came across a few promising clues at least directionally.

For instance, I dug up video footage of Brian conducting a 2016 Tax Lien Investing Bootcamp in Dallas.

Image Credit: https://www.facebook.com/taxliencode/videos/675519868120017/

And it showed extensive hands-on market research workshops with dozens of attendees crowded around courthouse due diligence terminals vetting live lien auction data right alongside his coaching team.

Additionally I discovered several older videos referencing one of Petersen’s mastermind events.

Image Credit: https://www.facebook.com/taxliencode/videos/314849801356236/

And they cited numerous promising developments like:

- Multiple students negotiating discounts on over-the-counter liens saving thousands in interest charges.

- Several members of the group apparently pooling resources to bid on high-value commercial tax liens none could’ve afforded solo.

- A few house-hacking enthusiasts even discussed joining forces to enter joint-ventures on inherited investment properties with questionable inhabitable status.

So at least from these limited samples, it seems like reasonable training outcomes are happening via Petersen’s knowledge sharing environments and mastermind events.

However, without more reporting on actual deals funded or profits made post-training, it’s tough to quantify the impact of these events beyond the fleeting event excitement & short-lived motivational spikes.

Final Thoughts On Brian Petersen The Tax Lien Educator

In closing, I’d say “cautiously optimistic” is my final take on Mr. Brian Petersen….

My “tin foil” hat conspiracy is that a lot of what Brian is doing seems to be carefully “curated” and it appears to me that he is just the new aged Ted Thomas, and he’s just being passed down the torch in the “Tax Lien” coaching scheme that has been being taught by guys like Ted since the early 90’s.

Image Credit: https://tedthomas.com/

On one hand, Petersen’s backstory checks out reasonably well from what I could validate. And past student customer satisfaction ratings do look really high overall.

However, his premium trainings tend to cater more towards newer investors who can be quite gullible unfortunately versus sophisticated real estate investors.

Oh I almost forgot as well – the very troubling details of the explosive Utah lawsuit naming Petersen!

Image Credit: https://www.courthousenews.com/wp-content/uploads/2019/09/Real-Estate-Scam.pdf

State prosecutors accuse the company “Real Estate Workshop” in which he was an associate of utilizing bait-and-switch advertising tactics, plus pushing people into dangerous debt levels to buy questionably overpriced courses.

Sound familiar?….🤔

And the suit directly names Petersen along with other top partners. So that gives me great concern over his integrity and ethics.

Now I can’t say for sure if he’s truly guilty or not as the suit looks unresolved presently.

However such severe allegations definitely invite tougher scrutiny in my book moving forward regarding anything to do with Brian Petersen.

In any case, I thought I’d share this inside look into what I found digging into Brian Petersen’s world so you guys can make fully informed decisions when evaluating his tax lien investment training programs for yourself.

Definitely size up all factors carefully in this situation. And approach things with your eyes wide open trusting no gurus 100% if you ask me.

In my opinion, the best way I’ve found to learn is by doing and “failing forward” as they say. I bought my 1st investment property in 2020 during the middle of (you know what..cough..cough), and I had no clue what I was doing despite spending months researching how to invest in real estate.

But guess what? I did it.

And learned a ton of valuable lessons along the way!

So, If you’re truly interested in tax lien investing, consider subscribing to my newsletter and following along my journey from landlord to “leinlord” as a new tax lien investor.

As Leinlord grows, my goal is to provide a “behind the scenes’ ‘ inside look at the tax lien auctions I participate in and thoroughly profile any properties that I win.

You’ll get to ride along with me as I walk through my risk analysis, deal structures, ROI calculations, bidding tactics, and exit strategies all documented for the world to see (even my L’s).

So please show your support and sign up for my newsletter OR if you are a Google Chrome user hit that “follow” button!

(screenshot instructions found on my about page:))

Additionally, if you’re interested in booking a consultation to talk tax lien strategy feel free to schedule a one-on-one here.

P.S. I am still fairly new to tax lien investing but willing to share what I’ve learned so far, so please keep that in mind before you book!

I’m not an expert… (yet)

Look forward to having you in the Leinlord community!

![Read more about the article How to Buy Land with No Money Down [7 Clever Ways]](https://leinlord.com/wp-content/uploads/2024/03/word-image-868-1-300x300.jpeg)