Table of Contents

Curious to learn what the US Tax Lien Association (USTLA) actually does?

You’re not alone…🫤

In this post, I’ll dive into what the USTLA is all about, but first, let me quickly explain what a tax lien is.

Essentially, it’s a legal claim against a property when the owner fails to pay their property taxes.

Investors can buy these liens and potentially earn interest or even gain ownership of the property if the owner fails to pay their debts.

Sounds interesting, right?

Well, the USTLA claims to be a “go-to”.resource for tax lien investing.

So let’s dive in and take a closer look…

Image Credit: https://ustaxlienassociation.com/

About The U.S. Tax Lien Association (USTLA)

The USTLA presents itself as an “authority” on tax lien investing, offering courses and seminars to teach people the ropes.

Their so called mission statement is filled with lofty goals about helping others achieve their dreams and solving cultural challenges.

They even have a top 10 list of reasons why they’re in business, which includes things like being the “#1 resource for tax lien investing” info and helping clients become “truly wealthy.”

Now that all sounds great, but one can’t help but wonder if it’s too good to be true…🤔

Image Credit: https://ustaxlienassociation.com/about/index.php

When Was The U.S. Tax Lien Association Established?

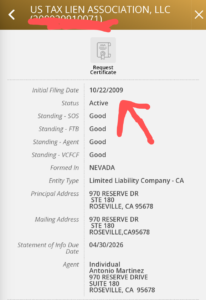

The USTLA was officially established on October 22, 2009 according to the California Secretary of State’s website.

To put that in perspective, that’s the same year that the iPhone 3GS was released, and the world was introduced to the “Balloon Boy” hoax.

Time sure flies, doesn’t it?

Image Credit: https://bizfileonline.sos.ca.gov/search/business

Who Started The U.S. Tax Lien Association?

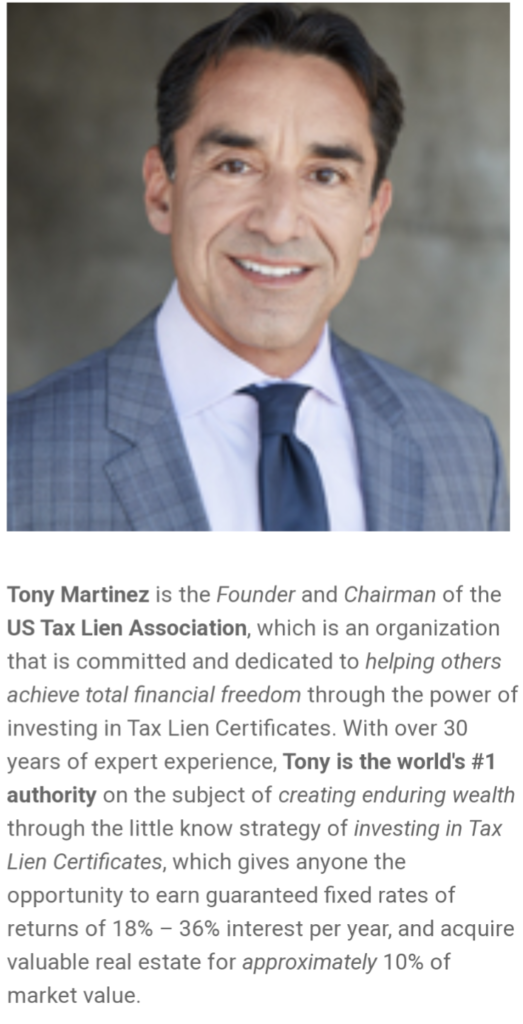

The masterminds behind the USTLA are Saen Higgins and Tony Martinez.

Tony claims he was a total mess in his 20s – unemployed, in debt, and living with his parents.

But he turned it all around after discovering tax lien investing.

Now, he and Saen are the go-to guys for teaching others about this “new” investment strategy.

(Tony Martinez) Image Credit: https://ustaxlienassociation.com/blog/three-thoughts-about-our-year-end-event-that-will-turn-your-world-upside-down-by-tony-martinez/index.php

(Saen Higgins) Image Credit: https://www.higginsmethod.com/

How Many Members Does The U.S. Tax Lien Association Have?

Here’s the thing: the USTLA doesn’t actually have any members.

Neither do they have a board of directors, or even bylaws.

It’s not your typical trade association.

In fact, there’s no evidence that it’s a non-profit organization at all like most trade associations.

(1st red flag)

You can search their nonprofit status for yourself below…

Image Credit: https://www.irs.gov/charities-non-profits/search-for-tax-exempt-organizations

Where Is The U.S. Tax Lien Association Headquartered?

The USTLA calls Roseville, California home. According to public records their exact address is 970 Reserve Dr, STE 180, Roseville, CA 95678.

I wonder if they have a nice view of the city?..🤔

Image Credit: https://www.loopnet.com/portfolio-property/970-Reserve-Dr-Roseville-CA/829704/

Why Was The US Tax Lien Association Established?

Despite the USTLA’s claims of wanting to help others, it seems that the primary purpose of the organization is to benefit its owners by selling courses and seminars.

This sets it apart from traditional trade associations that typically focus on supporting their members such as The National Tax Association (NTLA), which is the only tax lien trade association I’d recommend joining if you wanted to join one.

By the way joining a trade association to invest in tax liens is completely unnecessary, however personally I would join them solely for networking purposes and to meet with other like minded people and investors.

The education portion is a bonus, most of this information can be found online for free and on YouTube.

You can also subscribe to my newsletter for free!

(shameless plug..😎)

It’s going to be the place where I document my entire journey as a fairly new tax lien investor.

You’ll get to see all my strategies, tactics, processes, and even wins/losses during this journey.

So if you want to learn from my real life mistakes, consider subscribing!

Back to the article…😊

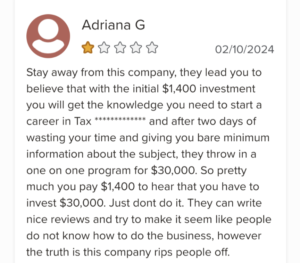

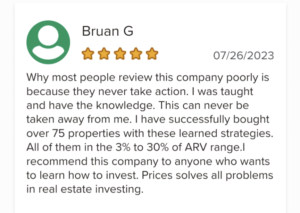

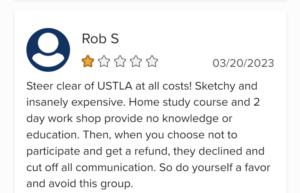

So here are some “member” testimonials I found online regarding Saen Higgins teaching methods, which I assume are the same as the USTLA.

US Tax Lien Association’s Brand Reputation

Now, let’s talk about the USTLA’s reputation.

They’ve got some positive reviews from people who claim to have found success with tax lien investing after taking their courses.

But there are also some pretty scathing complaints. Some folks feel like they were ripped off, paying thousands for information that didn’t deliver.

The USTLA has responded to these negative reviews, sometimes implying that the reviewers just didn’t take action or blaming misunderstandings.

But here’s where things get really interesting….

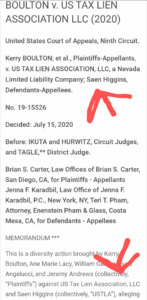

Around 2020, The US Tax Lien Association was also named in a court case where the plaintiffs accused them of misrepresentation and violating California business laws.

The court documents paint a picture of an organization that repeatedly ignored court orders, failed to provide requested information, and even had their attorney sending unprofessional emails to the opposing counsel.

In the end, the court recommended terminating sanctions and dismissing the case due to the plaintiffs’ “egregious conduct.”

Not sure what all that means but it doesn’t sound good..😕

You can read more about that case here..

Below are a couple screenshots I took of some negative as well as positive reviews regarding The US Tax Lien Association, feel free to read through them and come to your own conclusions..

Image Credit: https://www.bbb.org/us/ca/roseville/profile/training-program/us-tax-lien-association-llc-1156-47029212/customer-reviews

Image Credit: https://www.bbb.org/us/ca/roseville/profile/training-program/us-tax-lien-association-llc-1156-47029212/customer-reviews

Image Credit: https://www.bbb.org/us/ca/roseville/profile/training-program/us-tax-lien-association-llc-1156-47029212/customer-reviews

Image Credit: https://caselaw.findlaw.com/court/us-9th-circuit/2076568.html

Final Thoughts

So, what can we make of the U.S. Tax Lien Association?

On one hand, they present themselves as experts in tax lien investing with a mission to help others achieve financial success.

However, on the other hand personally I have great concerns about their business practices, negative customer experiences, and their conduct in legal proceedings.

So if you were considering investing in tax liens or working with The US Tax Lien Association, I’d recommend doing thorough due diligence prior to signing up as one of their members.

Research the risks and rewards of tax lien investing in general, read reviews from multiple sources, and consider alternative resources for education.

Don’t just take the USTLA’s word for it – look for objective, third-party information to help guide your decision.

At the end of the day, investing always carries some level of risk.

It’s up to you to weigh the potential benefits against the drawbacks and make an informed choice.

I hope this overview has given you a clearer picture of what the US Tax Lien Association is all about and some food for thought as you consider your tax lien investment education options.

In my opinion the best way I’ve found to learn is by doing and “failing forward” as they say. I bought my 1st investment property in 2020 during the middle of (you know what..cough..cough), and I had no clue what I was doing despite spending months researching how to invest in real estate.

But guess what? I did it.

And learned a ton of valuable lessons along the way!

So,If you’re truly interested in tax lien investing, consider subscribing to my newsletter and following along my journey from landlord to “leinlord” as a new tax lien investor.

As Leinlord grows, my goal is to provide a “behind the scenes” inside look at the tax lien auctions I participate in and thoroughly profile any properties that I win.

You’ll get to ride along with me as I walk through my risk analysis, deal structures, ROI calculations, bidding tactics, and exit strategies all documented for the world to see (even my L’s).

So please show your support and sign up for my newsletter OR if you are a Google Chrome user hit that “follow” button!

(screenshot instructions found on my about page:))

Additionally, if you’re interested in booking a consultation to talk tax lien strategy feel free to schedule a one-on-one here.

P.S. I am still fairly new to tax lien investing but willing to share what I’ve learned so far, so please keep that in mind before you book!

I’m not an expert… (yet)

Look forward to having you in the Leinlord community!

![You are currently viewing What Is The US Tax Lien Association? History Of [USTLA]](https://leinlord.com/wp-content/uploads/2024/02/About-Us-US-Tax-Lien-Association-logo.png)